Wish all your Christmases could come at once? We may not be able to make that happen, but here's a gift idea that could potentially set you up for many holiday seasons to come. Why not lift your spirits this Christmas with an ASX share investment?

We can help with that. We asked our Foolish writers which ASX stock they'd buy if they could choose only one to go in their investment stockings this festive season. Here is what they told us:

6 ASX shares to unwrap this Christmas (smallest to largest)

- DroneShield Ltd (ASX: DRO), $186.48 million

- Neuren Pharmaceuticals Ltd (ASX: NEU), $2.0 billion

- Lovisa Holdings Ltd (ASX: LOV), $2.33 billion

- Technology One Ltd (ASX: TNE), $4.81 billion

- Washington H Soul Pattinson & Company Ltd (ASX: SOL), $12.05 billion

- Resmed Inc (ASX: RMD), $14.73 billion

(Market capitalisations as at 11 December 2023).

Why our Foolish writers want these ASX shares under the tree

DroneShield Ltd

What it does: DroneShield develops and sells artificial intelligence-powered hardware and software to detect and disable drones. The company's clients include governments and militaries, airports, commercial venues, prisons, and critical infrastructure around the world.

By Bernd Struben: DroneShield has gone from strength to strength, which sees the share price up 61% in a year, with 2024 potentially seeing another year of outsized returns.

On 20 November, the company reported it had already received $62.9 million in cash receipts year to date, four times what it earned in all of FY 2022.

As for the outlook, management reported "a large and growing amount of customer demand for our counter-drone products, driven by continued use of small drones on battlefield and in terrorist activity, as well as other use cases".

According to Bell Potter, as of late November, DroneShield's contracted order backlog was $38 million, with a sales pipeline of some $400 million. The broker has a 45-cent price target on the stock, representing a potential upside of 48% from Monday's closing price.

Motley Fool contributor Bernd Struben does not own shares of DroneShield Ltd.

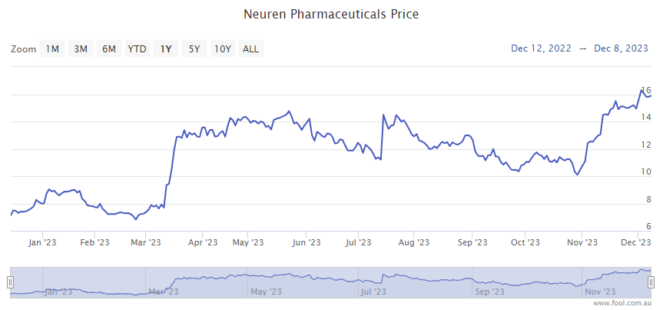

Neuren Pharmaceuticals Ltd

What it does: Neuren Pharmaceuticals develops therapies for rare neurodevelopmental disorders.

By Tony Yoo: The biotech company is in a unique position to research and develop new products while receiving global licensing revenue for its Daybue drug from US giant Acadia Pharmaceuticals Inc (NASDAQ: ACAD).

Daybue is currently the only approved treatment for the condition of Rett's Syndrome.

Despite a doubling of the share price over the past year, three of four analysts surveyed on CMC Invest still rate Neuren as a buy.

Motley Fool contributor Tony Yoo does not own shares of Neuren Pharmaceuticals Ltd.

Lovisa Holdings Ltd

What it does: Lovisa is a retailer of affordable jewellery. The two countries where it has the biggest presence are Australia and the United States. It has a sizeable presence in many other countries, including the United Kingdom, South Africa, France, Germany, and many more.

By Tristan Harrison: The Lovisa share price has declined by more than 20% since April 2023, so I invested recently for my own portfolio.

In the first few months of FY24, total sales had increased 17% year over year, which I think shows the company's compounding potential after already delivering many years of strong sales growth.

All it needs to do is keep opening stores (where it makes sense) in new and existing markets. I think there's plenty of growth potential in places like the US, China, Canada, Mexico and Vietnam.

According to the earnings projection from UBS, the Lovisa share price is valued at 17 times FY26's projected profit. I also like the longer-term trend of a growing dividend alongside the rising profit.

Motley Fool contributor Tristan Harrison owns shares of Lovisa Holdings Ltd.

Technology One Ltd

What it does: Technology One is Australia's largest enterprise software-as-a-service (SaaS) company.

By James Mickleboro: I think that Technology One's shares would be a good addition to a Christmas list this year. Particularly given a recent post-results pullback in its share price.

Thanks to the successful transition to a SaaS business model, its defensive end markets, and its expansion into the UK, I believe Technology One is well-positioned to grow its annual recurring revenue (ARR) at a strong rate long into the future.

Goldman Sachs certainly believes that this will be the case. It recently stated that it believes the company is "building the case for sustainable ~10-15% ARR growth with upside to TNE's 115% NRR [net revenue retention] target".

Goldman has a buy rating and an $18.05 price target on its shares.

Motley Fool contributor James Mickleboro does not own shares of Technology One Ltd.

Washington H Soul Pattinson & Company Ltd

What it does: Soul Patts is a diversified investment house that runs a large portfolio of underlying assets on behalf of its investors. It has been around for more than a century.

By Sebastian Bowen: Regular readers might think I sound like a broken record when discussing Soul Patts. But, to quote a certain Christmas film, 'true love lasts a lifetime'.

The reality is that If I could buy one ASX stock for Christmas, there is simply no alternative in my mind to Soul Patts. This company, after all, has returned an average of 12.5% per annum for investors (including reinvested dividends) over the past 20 years. You'd be hard-pressed to find other ASX shares that can say the same.

Buying Soul Patts is buying into a highly diversified portfolio of various other assets, including major stakes in several other blue chip ASX 200 shares. Together with its ever-rising dividend, this makes for one heck of a Christmas present.

Motley Fool contributor Sebastian Bowen owns shares of Washington H. Soul Pattinson & Company Ltd.

ResMed Inc

What it does: ResMed provides medical devices for treating respiratory conditions such as chronic obstructive pulmonary disease, insomnia, and sleep apnea. Founded 34 years ago, the healthcare company now hosts a range of sleep health products sold in more than 120 countries.

By Mitchell Lawler: I think it's hard not to be interested in a long-standing, quality business that has demonstrated consistent profitability and growth. ResMed has helped, and continues to help, many lives worldwide.

Yet, many investors discarded the company's formidable reputation throughout August and September. The popularity of weight-loss drugs has left many uneasy about what it means for ResMed's future, given sleep apnea's link to obesity.

I'm unconvinced that GLP-1 agonists are the miracle they're made out to be. For example, a clinical trial has shown approximately 40% of the weight loss among people taking Ozempic and Wegovy was lean muscle – giving another pause for thought before switching away from Resmed's products.

That is why I hope Santa drops some ResMed shares in my stocking this Christmas.

Motley Fool contributor Mitchell Lawler owns shares of ResMed Inc.