The Wesfarmers Ltd (ASX: WES) share price finished Wednesday's session 1% higher after the company announced the completion of its latest acquisition.

The positive reaction comes amid the S&P/ASX 200 Index (ASX: XJO) rising by 0.29% on a reasonably positive day for the ASX share market.

Wesfarmers is a major ASX retail share. It owns Bunnings, Kmart, Officeworks, and Priceline. Other retailers also finished higher today. The JB Hi-Fi Limited (ASX: JBH) share price closed up 2.3%, the Nick Scali Limited (ASX: NCK) share price gained 1.1%, and the Harvey Norman Holdings Limited (ASX: HVN) share price climbed 4.16% after its latest trading update.

Healthcare deal completed

Wesfarmers announced it had completed the acquisition of all of the shares of Silk Laser Australia Ltd (ASX: SLA).

Silk will become part of the Wesfarmers Health division, and will complement the Clear Skincare business by providing "additional scale and efficiency benefits in the attractive and growing market for medical aesthetics products and services".

The Wesfarmers Health director Emily Amos said:

Through this acquisition, we are looking to build a leading medical aesthetics operator in Australia and New Zealand.

We see strong operational and cultural alignment between our businesses and look forward to working with the SILK team and SILK's joint venture and franchisee partners to support their customers and deliver continued growth.

Wesfarmers paid a total of $3.25 per share to Silk Laser Australia shareholders to bring the total cash consideration to $3.35 per share, including a 10 cents per share special dividend paid to Silk shareholders since the announcement of the scheme.

When adding the two elements of the takeover together, it reflected an acquisition equity value of approximately $180 million.

Silk will apply to be removed from the ASX, which is expected to occur from the close of trade on 30 November 2023.

This deal adds to the other acquisitions that Wesfarmers has made in the healthcare space including InstantScripts and Australian Pharmaceutical Industries (which came with Priceline and Clear Skincare Clinics).

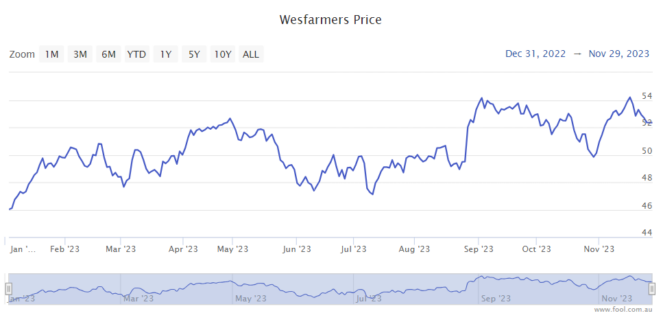

Wesfarmers share price snapshot

As we can see on the chart below, the Wesfarmers share price is up 16% this year and it has risen 7% over the last six months.