The Harvey Norman Holdings Limited (ASX: HVN) share price has recovered from a slight fall at the commencement of trading to be 3.74% higher this afternoon at $3.745.

The stock is likely rising due to lower-than-expected inflation data revealed by the Australian Bureau of Statistics mid-morning.

The data may signal the end of interest rate hikes, which is good news for retailers amid mounting evidence that Australian consumers are reining in their discretionary spending.

It appears this good economic news has offset the impact of poorer sales revenues revealed in a trading update that Harvey Norman released before market open today.

What did Harvey Norman report?

Harvey Norman announced a 7.8% decline in sales revenue for the period 1 July 2023 to 25 November compared to the same period last year. Comparable or like-for-like sales are down 8.7%.

The Harvey Norman share price fell to $3.57 in early trading, down 1.1% from yesterday's close of $3.61.

The retailer acknowledged that sales revenue from its international stores had been positively affected by currency appreciations. These include a 10.8% rise in the Euro, a 10.6% rise in the UK pound, a 2.6% rise in the New Zealand dollar, a 6.7% increase in the Singaporean dollar, and a 0.6% appreciation in the Malaysian Ringgit.

Harvey Norman's revenue downturn was led by its Australian business, with sales revenue down 11.6% (or 11.9% on comparables) over the period.

Harvey Norman noted it has opened five new stores during the second half of 2023. One is in Belconnen in the ACT, and four are in Malaysia.

Key competitor announces big sales boost

Harvey Norman's sales numbers are in stark contrast with competitor Temple & Webster Group Ltd (ASX: TPW) which also sells furniture and homewares but operates entirely online with no shopfront stores.

Temple & Webster revealed a 23% increase in sales revenue from 1 July to 27 November today. As a result of this and the inflation news, the Temple and Webster share price is up by 15.2% to $7.44 at the time of writing.

The sales revenue reports from the two furniture retailers come a day after the ABS released its retail sales data for the month of October.

It showed a 0.2% fall in turnover amid consumers holding off on purchases ahead of the Black Friday/Cyber Monday sales. Every category of retail spending fell, except for food retailing.

CBA economist Stephen Wu noted that the 1.2% annual rise in retail trade is the slowest rate of growth outside the pandemic since November 2010, despite the population increasing substantially this year.

That means per capita retail spending is now "undoubtedly weak", he said.

Massive first strike at AGM today

Harvey Norman shareholders delivered a first-strike vote of gigantic proportions at the annual general meeting today.

Almost 82% of shareholders voted against the company's remuneration report.

A strike is recorded against a company when the vote is 25% or higher.

Harvey Norman share price snapshot

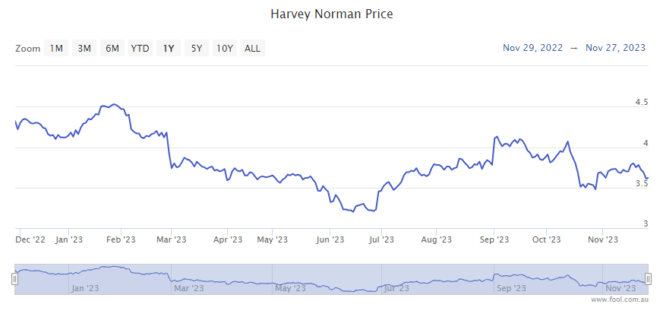

Harvey Norman shares are down 8.8% in the year to date compared to a 1.4% gain for the ASX 200.