ASX retail shares are trading higher on Tuesday following the four-day Black Friday and Cyber Monday weekend of sales.

The S&P/ASX 200 Consumer Discretionary Index (ASX: XDJ) is 0.5% higher at the time of writing.

The S&P/ASX All Ordinaries Index (ASX: XAO) is up 0.44%.

Australians were expected to spend a whopping $6.36 billion over the Black Friday/Cyber Monday weekend. This is up 3% on last year, according to the Australian Retailers Association (ARA), which partnered with Roy Morgan to prepare their spending predictions for this year's sales.

ARA CEO Paul Zahra said Black Friday and Cyber Monday sales would likely be "record breaking" in 2023.

Zahra expected they would take on greater importance than ever this year as consumers continue to struggle in the cost-of-living crisis.

He said the sales presented a great way to save money on Christmas presents. He noted the ARA has a "lukewarm spending projection" for the pre-Christmas period this year.

Australian consumers were so looking forward to the US-themed sales that the Australian Bureau of Statistics (ABS) reckons it contributed to a 0.2% fall in retail turnover in October.

Australians tightening their belts

The ABS released the latest official retail sales data today.

It showed retail turnover fell in all categories except food retailing in the month of October.

ABS head of retail statistics Ben Dorber said:

It looks like consumers hit the pause button on some discretionary spending in October, likely waiting to take advantage of discounts during Black Friday sales events in November. This is a pattern we have seen develop in recent years as Black Friday sales grow in popularity.

What's next for retail?

CreditorWatch's Chief Economist Anneke Thompson said she expected increased retail turnover in November as a result of the US-themed sales extravaganzas.

She commented:

We expect that all categories of goods spending will see a good lift in spending in November due to these sales, following patterns that have emerged in recent years.

Thompson noted that spending on cafes, restaurants, and takeaway food services recorded a second consecutive month of falls in October, after bucking the trend in discretionary categories for months.

She pointed out that this category of retail spending is not affected by Black Friday or Cyber Monday sales, commenting:

Spending in this category fell by 0.4 per cent and is now back to July 2023 levels. This indicates that consumers have finally started to pull back on dining out, in the face of cost-of-living pressures and rising interest rates.

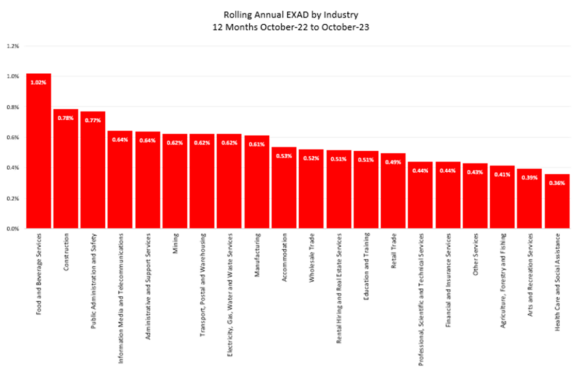

What is concerning is that this sector already well and truly tops the rankings for external administrations by Industry. In the 12 months to December 2023, one in 100 food and beverage services businesses went into external administration.

There are now rising headwinds in this sector, as demand falls, the ATO calls in large GST and other tax debts, and labour, rent and energy costs all continue to rise.

The food and beverage sector is also the second highest ranked industry for payment arrears (behind construction), with 9.3 per cent of total invoices more than 60 days in arrears.

Source: CreditorWatch

In The Australian, CBA economist Stephen Wu noted that the 1.2% rise in retail trade over the past year is the slowest annual growth rate outside of the pandemic since November 2010.

Not only is that concerning on its own, it comes amid the population growth rate almost doubling.

"In other words, per capita retail spending is undoubtedly weak," he said.

How are ASX retail shares performing today?

Here's a snapshot of how the big-name ASX retail shares are performing today and over the year to date (ytd).

- JB Hi-Fi Limited (ASX: JBH) shares are up 1.04% to $46.50 and up 10% ytd

- Harvey Norman Holdings Limited (ASX: HVN) shares are up 0.84% to $3.60 and down 12% ytd

- Nick Scali Limited (ASX: NCK) shares are up 0.47% to $10.80 and up 2% ytd

- Premier Investments Limited (ASX: PMV) shares are up 0.81% to $23.61 and down 5% ytd

- Myer Holdings Ltd (ASX: MYR) shares are up 0.38% to 53 cents and down 21% ytd

- Super Retail Group Ltd (ASX: SUL) shares are down 1.29% to $13.39 and up 24% ytd.