A2 Milk Company Ltd (ASX: A2M) shares are in the red on Wednesday amid key competitor Bubs Australia Ltd (ASX: BUB) requesting a trading halt pending a potential capital raising.

A2 Milk shares are currently $3.935, down 1.87% at the time of writing on Wednesday.

Bubs shares are frozen at 16.5 cents per share following the ASX granting the company's trading halt request this morning prior to the market open.

The company has stated that the potential capital raise would provide funds for its United States expansion.

Bubs has requested the halt to remain in place until it makes an announcement, or until the commencement of trading on Friday — whichever comes first.

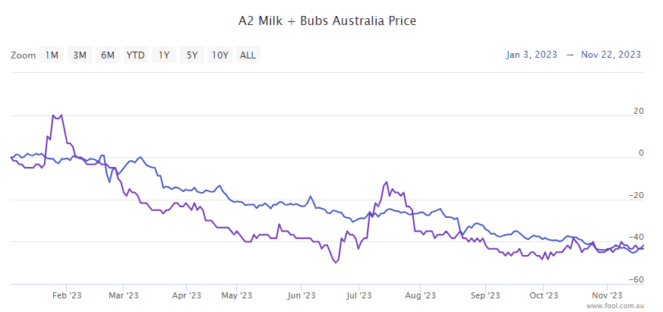

Seriously spilt milk in 2023 for Bubs and A2 Milk shares

The share prices of these two infant milk formula companies have plunged in the year to date.

Check out the chart below.

A2 Milk shares have declined by 41% in 2023. Bubs shares have fallen by 45%.

At the recent A2 Milk annual general meeting, Managing Director and CEO David Bortolussi acknowledged the poor performance of the shares in 2023.

Bortolussi said: "I understand that our shareholders are disappointed with the company's share price. So am I and the rest of your management team."

The market challenges for A2 Milk and Bubs

As we covered on the day, the A2 Milk CEO explained that COVID-19 had a "substantial impact" on the business.

He also said the China market for A2 Milk has "declined significantly". This is due to fewer babies being born and lower market pricing.

He added:

These category issues – coupled with challenging macro-economic conditions, global geopolitical concerns and capital market dynamics – have weighed heavily on our share price over time.

On the plus side, A2 Milk made no change to its FY24 guidance. This was a pleasant surprise for top broker Citi. The next day, the broker upgraded A2 Milk shares to a buy rating with a $4.81 price target.

Bubs also held its AGM last week.

CEO Reg Weine said the company's FY23 performance was "not a great set of numbers". But he assured shareholders that "we have completely de-risked the balance sheet and are now investing for growth".

Weine referred to the US business as "our growth engine", with Bubs enjoying a first-mover advantage in goat milk formula.

The Bubs CEO said:

The USA remains our big bet and growth engine and we have grown revenue 200% year on year, and we expect FY24 revenue to grow by a further 100% over FY23.

As you know Bubs was granted a unique opportunity under the US enforcement discretion and project fly formula and the company has made the most of this opportunity with broad distribution across the US.

We are well distributed across almost all of the major brick and mortar retailers and we are stocked in approximately 5900 outlets across the US.