Could you do with an extra $1,000 each month?

That's a rhetorical question — of course you would!

Believe it or not, it's not difficult to put yourself into a position where such passive income could become reality.

How? Using ASX shares, of course.

Take a look at this hypothetical to get your juices running:

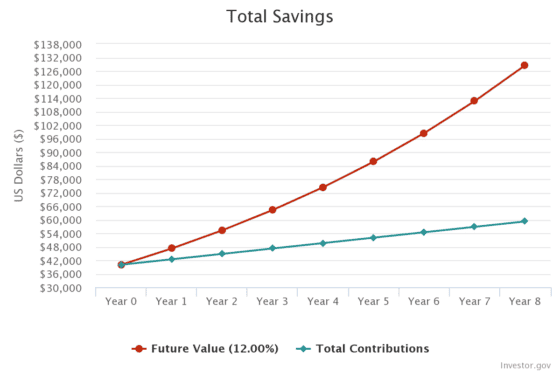

Eight year growth plan

A recent survey by comparison site Finder found the average Australian has $40,000 saved in the bank.

Let's take this as the starting point for an ASX stock portfolio.

You can expand this nest egg many ways, but I like picking out a diversified batch of ASX growth shares to do the job.

A couple of tempting examples at the moment are retailer Lovisa Holdings Ltd (ASX: LOV) and mining tech provider RPMGlobal Holdings Ltd (ASX: RUL).

Experts seem to be bullish on both, and they have demonstrated in the past that they can provide chunky returns over the long term.

Lovisa has gained about 142% over the past five years, and that's excluding dividends. RMPGlobal shares are now trading a whopping 160% higher than they were a half-decade ago.

They equate to amazing compound annual growth rates (CAGR) of 19.3% and 21% respectively.

Of course, not every stock you choose will do that well, regardless of how much research you do.

Let's say your portfolio as a whole achieves a more modest 12% annually.

That initial $40,000, with $200 added each month, could turn into $128,557 after just eight years.

Well done. Now we can try to extract $1,000 of passive income each month.

Lifetime passive income plan

So how do we harvest that income without endangering the pot, so that I can just keep going indefinitely?

The straightforward way to do this is to sell the capital gains each year and pocket the proceeds.

Even if we assume after eight years Lovisa's and RPMGlobal's businesses have matured to the point that their CAGR slows down to 10%, that's still $12,855 of passive income in your pocket.

That's more than $1,000 per month.

The downside to this approach is that, as we all know, share markets can experience wildly varying fortunes from year to year.

That means the actual amount received on any given year could be anything between a massive windfall or $0.

If you seek more consistency, perhaps selling the entire portfolio then constructing a new one full of ASX dividend shares might be the go.

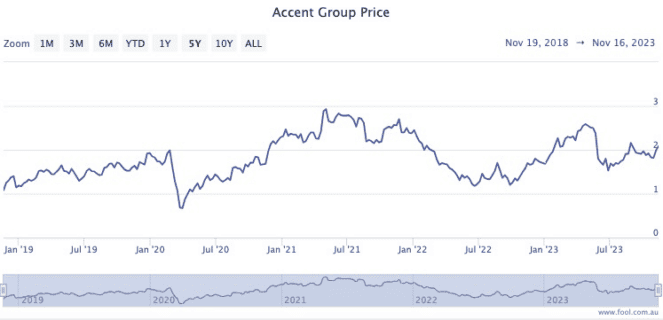

A pair of examples that professional investors currently have their eyes on are real estate funds manager Centuria Capital Group (ASX: CNI) and retail conglomerate Accent Group Ltd (ASX: AX1).

I have mentioned in the past that Australia's tax system means it's not unrealistic to reap 10% of yield after franking.

That level of dividend yield will also deliver you $1,000 of passive income monthly from your $128,557 portfolio.

The two different methods have tax implications, so it's best to seek professional advice to help you choose.

But I hope this hypothetical shows you how you can get to a nice stream of passive income in just eight years.