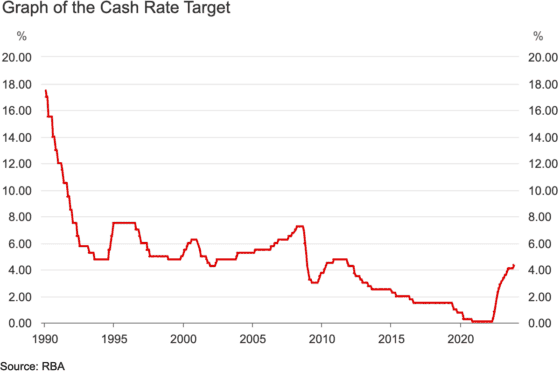

The interest rate hike that the Reserve Bank sprung this week is absolutely painful for many Australians who were already struggling.

However, as stock investors, it's important to look to the future rather than focus excessively on the present.

And Shaw and Partners portfolio manager James Gerrish reckons the rate rises could be done.

"We believe this journey has reached its conclusion, and economic contraction in 2024 will eventually necessitate rate cuts," he said in his Market Matters newsletter.

"It feels like ages since those were considered."

This means that it's now time to buy into ASX sectors that are interest rate sensitive or, to put it another way, dominated by growth stocks.

They were the ones that have been punished over the past two years as the cost of money rose steeply.

The most rate-sensitive ASX sectors

The three sectors that Gerrish's team is keen on are technology, health and real estate.

Technology has already rocketed 22.7% so is probably the most "mature" in its revival, according to Gerrish, while healthcare (down 10.1%) and real estate (down 1.7%) are both presenting excellent value.

At the moment, the Market Matters team's portfolio is overweight in technology, market-weight in health and overweight in property.

"Hence, at this stage, our portfolio is largely positioned as we want into 2024," said Gerrish.

"However, if we decide to increase our exposure to rate-sensitive names into 2024, it's likely to be through the battered real estate and/or infrastructure sectors, where we see some deep value."

As for individual stocks, Gerrish revealed that his portfolio currently held these:

- Technology: Altium Limited (ASX: ALU), Xero Limited (ASX: XRO)

- Healthcare: Ramsay Health Care Ltd (ASX: RHC), Resmed CDI (ASX: RMD)

- Real estate: Goodman Group (ASX: GMG), National Storage REIT (ASX: NSR)

"Healthcare – good risk/reward at current levels, at least for a bounce into 2024," said Gerrish, adding that for real estate, he was "looking for at least +15% upside after a tough 2 years".