Last month was a bit of a disaster for ASX stocks, with the S&P/ASX 200 Index (ASX: XJO) falling 3.8%.

That was the worst October since 2018.

So in this environment, shares that rise against the tide stand out.

Here are two examples that the team at Elvest are backing for further gains:

Doubled in a year, but plenty more where that came from

Funnily enough, the Smartgroup Corporation Ltd (ASX: SIQ) share price soared 3.6% last month because of another business' update, not its own.

"Smartgroup Corporation rallied following salary packaging peer McMillan Shakespeare Ltd (ASX: MMS) 1Q24 trading update, which credited a 28% increase in novated leases to strong electric vehicle (EV) demand," Elvest analysts said in a memo to clients.

The idea is that this industry tailwind will also benefit Smartgroup.

"This bodes well for Smartgroup Corporation as a pure-play novated lease and salary packaging provider."

Smartgroup is one of those investments that can be considered both a growth and a dividend stock.

Amazingly, the Smartgroup stock price has almost doubled over the past year, going from around $4.70 to the $9 mark.

At the same time, it boasts a chunky dividend yield of 5% fully franked.

No wonder six out of eight analysts currently rate Smartgroup as a buy, according to CMC Markets.

The ASX stock that provides both growth and income

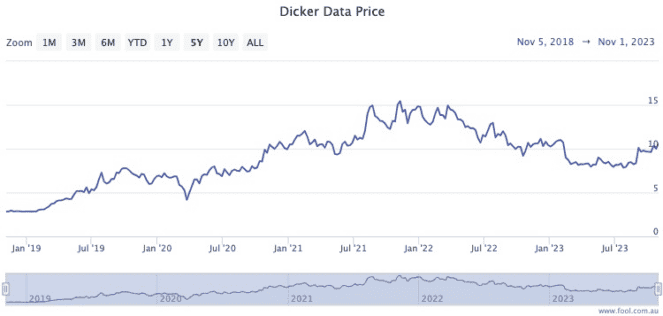

Technology distributor Dicker Data Ltd (ASX: DDR) is another dual growth-income combo stock.

The share price has risen an impressive 287% over the past five years, while it's currently paying out a fully franked 3.25% dividend yield.

The last few weeks have been phenomenal for Dicker Data shares, rocketing 30.8% since 29 August.

Elvest analysts loved the latest numbers from the business.

"Dicker Data delivered a solid quarterly update, with calendar-year-to-date revenue and pre-tax earnings up 8.0% and 10.4% respectively.

"Highlights included healthy growth in Dicker Data's software and DAS divisions, whilst higher group margins largely reflected improved NZ business performance."

Morgan Stanley (NYSE: MS) analysts last month also named Dicker Data as one of their dividend stocks to buy.

"The team at Morgan Stanley is expecting Dicker Data to continue growing its dividend in the coming years," reported The Motley Fool's James Mickleboro.

"It is forecasting fully franked dividends per share of 43.9 cents in FY 2023 and 48.9 cents in FY 2024."