A fund manager has picked out two S&P/ASX 100 Index (ASX: XTO) shares that it thinks are very undervalued. Those stocks are toll road businesses Transurban Group (ASX: TCL) and Atlas Arteria Group (ASX: ALX).

Transurban has toll road assets in the US and Australia, while Atlas Arteria has roads in France, Germany and the US.

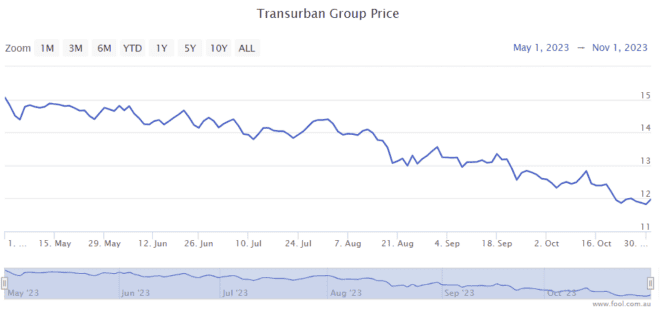

Over the past six months, the Transurban share price has fallen by over 17%, as we can see on the chart below.

It has also been a rough time for the Atlas Arteria share price, which has fallen by more than 16% in the last 12 months, as we can see on the chart below.

The businesses have been suffering amid the higher interest rates and bond rate environment.

Toll roads are still performing

The fund manager Atlas Funds Management recently gave some very positive commentary on the ASX 100 shares Transurban and Atlas Arteria.

It pointed out that the quarterly update from Ampol Ltd (ASX: ALD) showed an 11% increase in Australian fuel sales, so it wasn't a "great surprise" to see that the toll road operators reported "strong" traffic numbers in October.

The fund manager noted that Transurban reported record average daily traffic across the network with 2.5 million trips per day, with traffic up 3% year over year.

Atlas Arteria saw traffic increase by 2.3% in the last quarter, thanks to growth in the French assets, which helped revenue grow by 6.1%.

The fund manager said that because of the impact of quarterly escalators (price rises) on the inflation-linked tolls and long-term fixed-rate debt, higher traffic will "see expanding profit margins."

How undervalued are these ASX 100 shares?

Atlas Funds Management reminded investors of one of Warren Buffett's quotes, which he himself got from Benjamin Graham: "In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

In other words, the underlying performance of these two businesses should help the Transurban share price and Atlas Arteria share price over time.

The fund manager pointed out that some businesses are trading at near the lows of March 2020, even though some ASX (100) shares have "better operations and higher profits" in 2023.

The investment team at Atlas said that both Transurban shares and Atlas Arteria shares are trading at a 25% discount to their pre-COVID share price despite higher traffic volumes and toll prices.

Share price snapshots

Since the start of 2023, the Transurban share price has fallen 5.7% and the Atlas Arteria share price has declined 17%.