I really like finding good ASX dividend shares that are capable of offering strong returns while also being undervalued. If I can find that sort of opportunity, then it might be possible to get a combination of both good dividends and capital growth.

I want to point out that something isn't necessarily undervalued just because it has fallen, and a business isn't necessarily a buy just because it has a large yield.

In my opinion, these two ASX dividend shares could be opportunities.

Centuria Capital Group (ASX: CNI)

This is a property fund manager that focuses on running listed and unlisted funds that invest in commercial property. It operates real estate investment trusts (REIT) that investors may recognise such as Centuria Industrial REIT (ASX: CIP) and Centuria Office REIT (ASX: COF).

Since the start of 2023, the Centuria share price has fallen 31% and it's down by close to 70% from September 2021, as we can see on the chart below.

The business said that its balance sheet is positioned to fund organic growth. It also said that in FY24, it has guided that it will generate between 11.5 cents to 12 cents of operating earnings per security (EPS).

The business now seems oversold to me. For starters, the Centuria share price is now trading at 10x the conservative end of its guided operating earnings, which I think is low.

It also said that it's going to pay a distribution per unit of 10 cents per security. That works out to be a guided forward distribution yield of 8.7%.

I think it's likely that commercial property values will fall, but that's why the Centuria share price has declined. I don't believe that interest rates are going to rise forever – we're probably near the top, so that headwind may lessen for the ASX dividend share. Businesses still need commercial spaces and the industrial property sector is actually performing well because of strong demand and limited supply.

Its properties have a high occupancy rate, providing good rental income and visibility. Centuria has a development pipeline of $1.6 billion which can help further grow funds under management (FUM) (or offset declines).

Premier Investments Limited (ASX: PMV)

Premier Investments is an ASX retail share that owns a number of brands including Just Jeans, Jay Jays, Peter Alexander, Smiggle and Dotti.

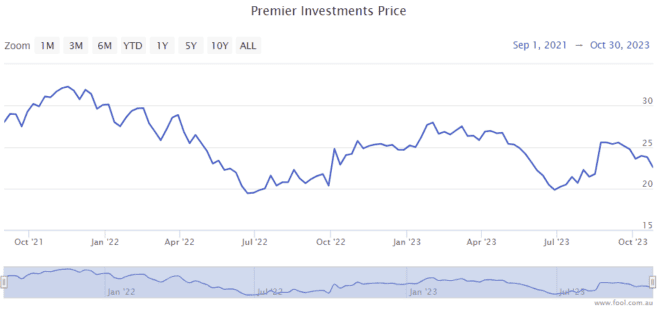

As we can see on the chart below, the Premier Investments share price has fallen 14% from 4 September and it's now almost back to the level just before it announced it was commencing a strategic review of the business. It's down around 30% from the 2021 peak.

I think Premier Investments is a very compelling business, with a strong track record of performance in growing nationally and globally.

The long-term looks promising for the ASX dividend share, with expectations of dozens of new stores in the near term. It's looking at future offshore market opportunities for Peter Alexander and Smiggle.

Its online sales are very profitable, so if it can keep growing its e-commerce sales then profitability could remain elevated.

According to the projections on Commsec, the Premier Investments share price is valued at just 14 times FY24's estimated earnings with a possible grossed-up dividend yield of 7.4%.