Great companies can come in all different shapes and sizes. However, ASX shares in the small-cap segment hold the potential to deliver life-changing returns.

Given their initial stature, small companies can offer enormous growth before reaching market saturation, whereas large companies often contend with slowing expansion.

The skill then lies in determining which ASX small-cap shares have the ingredients to evolve into much bigger businesses over time.

Imagine replicating the success of investing in CSL Limited (ASX: CSL) after it hit the ASX boards in 1994 for less than $400 million, a business that now towers over the Australian share market with a market capitalisation of almost $130 billion.

Big future ahead for these ASX small-cap shares?

Emulating the returns of CSL is a tall order. The incredible growth story of the biotechnology company is an extreme outlier. However, I'm confident numerous ASX shares are still yet to graduate from small-cap to blue-chip status.

Here are a few I believe are on the right path.

Collins Foods Ltd (ASX: CKF)

The largest operator of KFC franchises in Australia has already established a meaningful presence. Opening its first restaurant in Queensland in 1969, KFC now operates 300 restaurants across Australia, Germany, and the Netherlands.

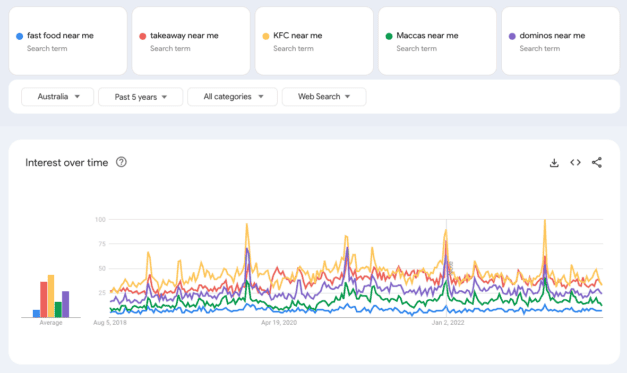

By paying a modest royalty to Yum! Brands, Collins Foods taps into what has become a highly recognisable fast-food outlet. In Australia, KFC has continuously outranked McDonald's and Domino's for searches 'near me' over the last five years, as shown below.

The growth levers for Collins Food from here are expanding into new markets and brands. If the management can successfully execute, I see no reason why this ASX small-cap share couldn't find itself in the same league as Domino's Pizza Enterprises Ltd (ASX: DMP) — a company nearly four times the size.

Nanosonics Ltd (ASX: NAN)

Some of the most entrenched blue chips in the world are medical device companies. These businesses tend to enjoy exceptional margins due to patented technology and the razor-and-blade business model.

Still residing among the small-caps, Nanosonics makes and sells specialty devices to automate the disinfection of medical equipment.

In my view, it's the early innings for Nanosonics, with the company heavily geared towards growing its presence in the market. Most of the revenue generated is consumed by selling expenses and further research and development. As such, I believe Nanosonics' full earnings potential is yet to be witnessed.

Healthcare systems worldwide have been strained, and funding is under constant pressure. Earlier this year, it was reported NHS Scotland had to outsource decontamination services as it faced "capacity challenges". Such challenges will likely become more common, demanding more innovative solutions like those provided by this ASX small-cap share.

Nick Scali Limited (ASX: NCK)

Selling couches and high-end furniture sounds like a boring business. Although, that hasn't stopped US-based RH (NYSE: RH) from becoming a US$8.6 billion company. The Australian version of this luxury empire is arguably locally listed Nick Scali.

The furniture retailer doesn't receive the 'clout' some tech companies might, but its impressive performance is undeniable. For example, Nick Scali achieved a return on capital employed (ROCE) of 35% in the last year, exceeding the 20% ROCE of high-flying tech darling WiseTech Global Ltd (ASX: WTC).

Over the past decade, Nick Scali's annual revenue has grown from $118.5 million to $544.5 million. Despite this clinical display of retail excellence, the company trades on a price-to-earnings (P/E) ratio of 8.5 times earnings.

In my opinion, this grossly undervalues what is a high-quality business. As a brief justification, I expect Nick Scali will still operate as a business in another decade and generate significantly more profits.

If the fundamentals maintain this high standard, I suspect this ASX small-cap share could be in the big leagues someday.