The Harvey Norman Holdings Limited (ASX: HVN) share price has had a rough time coming off the high of rapid-fire retail spending.

One minute it's the sugar hit of economic stimulus, the next it's the hammer of central banks. Amid a new cycle defined by higher inflation and interest rates, investors have been quick to scamper from the retailer and its shares. The result is an 18% drawdown in the share price over the last year.

Now looking forward, we took two of our writers to task over the prospects for Harvey Norman. Here's what they had to say:

Beautiful business model at a good price

By Mitchell Lawler: Harvey Norman has been around for more than 40 years. During that time, the company has leveraged its franchise business model and brand to build a substantial real estate portfolio.

At the end of the first half of FY2023, the multinational retailer held $4.46 billion in net assets, $3.94 billion of which were tangible property assets. The gain continued a steady trend that has seen Harvey Norman's net assets grow at a 10.8% compound annual growth rate (CAGR) over the past three years.

The Harvey Norman story is a familiar one. Much like how McDonald's Corp (NYSE: MCD) built its empire, Gerry Harvey – co-founder and chair of Harvey Norman – built his business upon the franchise model, extracting value from its brand.

In turn, the company is able to generate higher margin earnings than its competitors. For the 12 months ending December 2022, Harvey Norman secured a net profit margin of 26.6%. In stark contrast, retail rival JB Hi-Fi Limited (ASX: JBH) pulled a 6.1% figure.

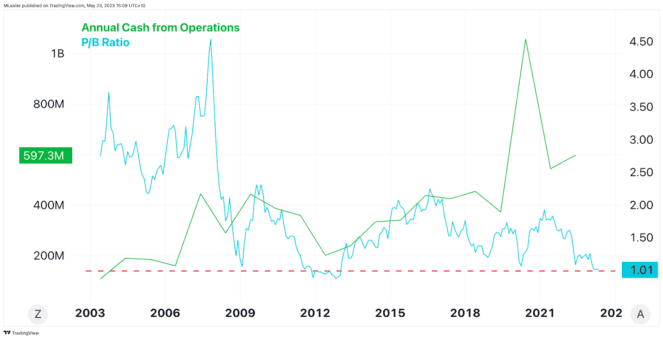

The company's cash-generating abilities remain strong in the face of wallet-biting inflation. Yet, investors have sold Harvey Norman shares off to levels not seen since the GFC, 2012, and the pandemic in price-to-book (P/B) terms.

Data by Trading View.

As shown in the chart above, Harvey Norman is now trading on roughly its book value. In my opinion, this is due to recession fears. However, even if consumer spending were to temporarily collapse, the balance sheet appears to be clean enough to get it through a tough stretch largely unscathed.

In the meantime, I'd personally be taking advantage of these depressed valuations and waning sentiment.

Further profit pain to come

By Tristan Harrison: The Harvey Norman share price has dropped around 20% from the end of January 2023. I don't believe it's going to halve from the current price, but there is scope for the business valuation to keep falling.

The last few years have seen an enormous amount of extra demand for the products that Harvey Norman sells, thanks to government stimulus and pent-up demand for home products.

As Warren Buffett's first investment mentor, Benjamin Graham, once said:

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

In other words, the share price of a business follows its earnings over time.

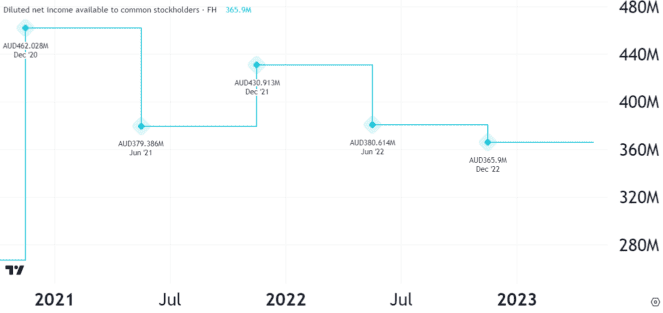

As we can see on the chart below, Harvey Norman's half-year net profit has been trending lower since the bumper result of December 2020.

Source: TradingView, Harvey Norman's half-year net profits between December 2020 to June 2022

This profit decline has been occurring arguably before the 'real' impact of higher interest rates has flowed through to households. Plus, higher interest rates are, in theory, meant to push down on valuations. This could prove to be a headwind for its owned property values.

We only just heard from JB Hi-Fi in early May that its quarterly sales for the three months to March 2023 were starting to show a comparable decline in Australia. I think Harvey Norman could see further pain in Australia over the rest of 2023 if/when higher interest rates bite.

I don't think Harvey Norman shares are permanently going to go to $3 (or under) – discretionary retailers sometimes see demand shift over time. The company's international growth is helping its long-term potential, but its core market of Australian retailing looks wobbly.

I don't think the market is fully reflecting the potential negative outcomes later this year, which could mean the Harvey Norman share price drops if earnings disappoint. In the longer term, online competition could also be problematic for bricks and mortar retailers like Harvey Norman.