1. Just when you thought this almighty share market rally might have been coming to an end, the Dow snaps a two-day losing streak and jumps 450 points higher.

According to Marketwatch, investors gained confidence from stabilising crude oil markets, some better-than-expected corporate earnings reports, and expectations for Congress to roll out another fiscal stimulus package.

One of the emerging themes from the coronavirus pandemic is the surge in e-commerce transactions. Shopify Inc (NYSE: SHOP) last week said its platform was handling Black Friday level traffic every day. Shopify shares jumped another 7% higher overnight to another all-time high, and are up almost 70% in the past month.

2. As the Dow goes, so does the Australian share market, with the S&P/ASX 200 Index (ASX: XJO) jumping higher at the open.

Yesterday, the ASX recovered from a steep intraday fall to close flat on the day. Quoted in the Australian Financial Review (AFR), Simon Doyle from Schroders said the market went from expecting a pandemic depression to then a V-shape recovery. He went on to say there will be a path out of this coronavirus crisis, but it's not going to be smooth.

3. Market prognosticators are trying to work out whether we've permanently passed the bottom or if there is more pain to come.

Exactly 1 month ago the ASX 200 traded hit 4,403 at which point the index had plunged almost 39% in a little over a month.

Today, by comparison, the ASX 200 is at cruising altitude, closing in on 5,300.

Even bad news is good news, with a subdued trading update from Carsales.Com Ltd (ASX: CAR) seeing its share price jump 4.1% higher to $13.49 in early trade.

So have we passed the bottom of the market?

I'll let you know for sure in 12 months' time. That said, it sure feels like it at the moment, especially as the new daily coronavirus cases here in Australia have fallen to low double digits.

Still, as ever, the near-term fate of the ASX 200 will be determined by the movements on Wall Street.

4. US entrepreneur Mark Cuban said on Fox Business the economy's recovery from coronavirus is going to be brutal, saying that while he remains confident that some normalcy will return in 2 to 3 years, we'll have to endure some pain to get to the other side.

Last week Cuban was quoted on Marketwatch as saying…

"Three years, five years from now, the market will be up from where we are today."

When the stock market is jumping all over the place, either lulling you into a false sense of security or scaring you senseless, it can be hard to keep your eye on the longer-term prize.

Michael Frazis of Frazis Capital Partners recently said the end of March described an almost perfect situation for equities, being…

- a temporary shock, with early signs that the temporary shock was abating,

- a 30-40% decline across major market indices, with low-quality small caps and cyclicals down twice as much,

- a total derisking/move to cash/ increase in short interest by both retail and professional investors alike,

- enormous fiscal and monetary easing. Rates at zero. Cash transfers to businesses and citizens around the world, with a dramatic increase in payments to the unemployed

Needless to say, Frazis remains optimistic of the 5 and 10-year view from here, even if the 6-month view is cloudy at best.

5. According to the AFR, the local office of Goldman Sachs is anticipating some smaller superannuation funds will need to dump equities as over one million Australians are expected to early access up to $20,000 from their super over the next two financial years.

You have to feel for superannuation funds, especially those with younger members. With billions under management, and an investing time frame extending to decades, many super funds have increasingly been investing in non-quoted and therefore more illiquid assets, like infrastructure assets including airports, and commercial property.

In order to meet early super redemptions, such funds have no choice but to sell down their equity holdings, something that puts pressure on share prices.

6. Although it should have been obvious to blind Freddy, it seems the market was not quite pricing in a surge in new e-commerce customers for Kogan.com Ltd (ASX: KGN).

Earlier in the week, Kogan said March saw the largest monthly increase in active customers since its IPO. March gross sales grew more than 50% with gross profit in March also more than 50% higher.

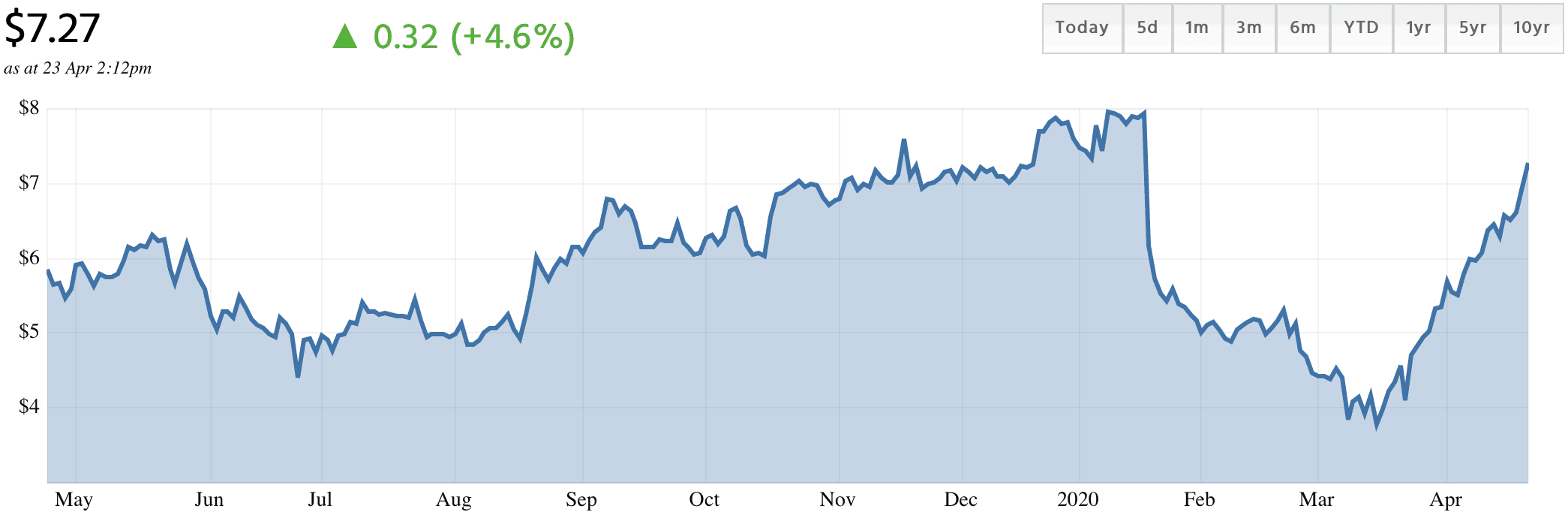

The 1-year Kogan share price chart is definitely of the V-shaped variety, its share price having fallen from $8 to a low of $3.45 before jumping back to $7.27 today.

Kogan shares are definitely one for your watchlist. At a time when many companies are deferring or scrapping their dividends, even its 2.18% fully franked dividend yield looks attractive.