The tug-of-war between bulls and bears rages on and the latter group appears to be gaining ground with the expected fall in the S&P/ASX 200 Index (Index:^AXJO) this morning.

But whether we've really entered into a new bull market or not, the outlook for gold couldn't be brighter!

This might sound like a contradiction as the precious metal is regarded as a safe haven asset. It's supposed to outperform during times of economic stress and turn lacklustre during the good times.

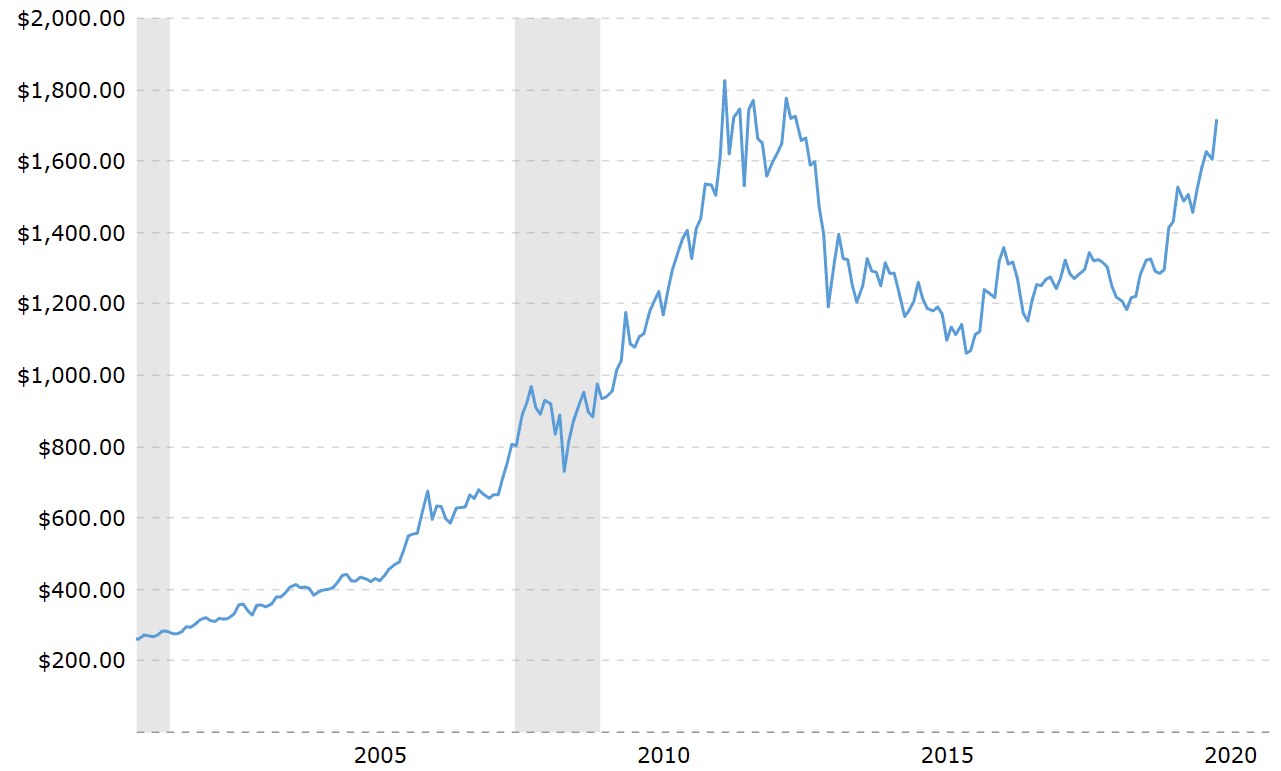

However, I suspect the yellow metal will be testing its record high set in 2011 before the year is out.

If this comes to pass, it would be good news for ASX gold miners like Newcrest Mining Limited (ASX: NCM), Evolution Mining Ltd (ASX: EVN) and Northern Star Resources Ltd (ASX: NST).

Gold closing in on record highs

As it is, the spot gold price isn't that far off the circa US$1,900 an ounce peak it reached nearly nine years ago. The price of the commodity currently stands at just over US$1,700 per ounce.

There are a few reasons why I am a gold bull even though I believe the worst of the COVID-19 pandemic is behind us.

Historically, the gold price tends to perform best after a recession or a bear market. This was certainly the case during the GFC and the 2001 tech-bust.

Source: Macrotrends.net

Cheap money to fuel gold bugs

There's a good reason for this. It's linked to cheap money that central banks pump into the financial system to soften the hard economic landing.

There's never been a time when money was as cheap as it is now. Governments and central bankers have unleashed an unprecedented amount of stimulus to contain what is predicted to be the worst recession since the Great Depression.

This makes conditions particularly bright for gold – an asset that doesn't generate a yield. But investors can't get much of a yield anyway from other safe assets, so this isn't much of a drawback.

Can gold jump to over US$2,000?

Further, the extreme quantitative easing (QE) measures that the US Federal Reserve is about to embark on will put pressure on the US dollar. A weakening greenback is supportive of the gold price.

These tailwinds will persist even as the world starts to recover from the coronavirus crisis, and this will allow gold to stay on the front foot for some time yet.

Given how close the gold price currently is to its previous record, and the fact that we are closer to the start of QE than the end, I wouldn't be surprised to see the precious metal jump above US$2,000 an ounce.