It's now been a month since the launch of the S&P/ASX All Technology Index (ASX: XTX) and what a month it's been. It turned out the index launched just as the coronavirus pandemic escalated in Australia, taking the share market down with it.

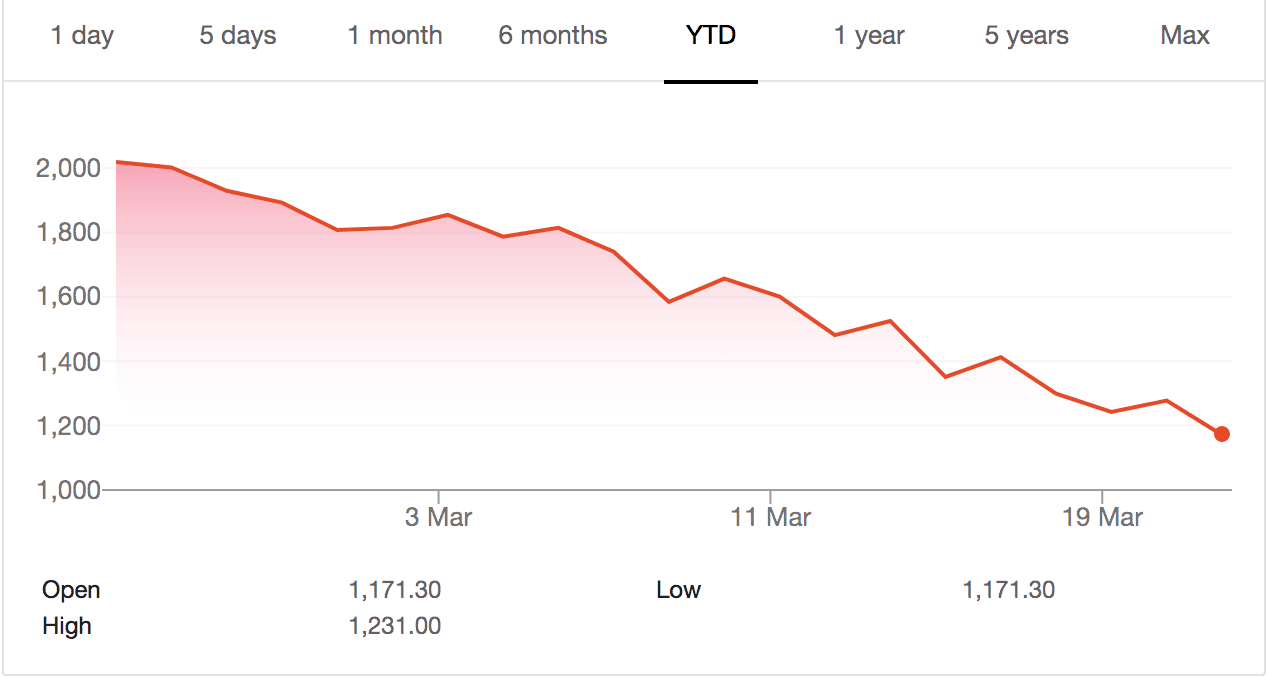

In the past month, the ASX 200 has fallen 35% while the All Technology Index has fallen 42% (as at yesterday's close). The index's downward slide can be seen in the screenshot below.

When the index launched on 24 February, hopes were high that it would provide more opportunities for investors wanting exposure to Australia's ASX technology companies and greater opportunities for emerging companies to gain access to capital.

It is highly likely these aims will be achieved once current conditions abate. In the meantime, it's a wait and see game with many of the major constituents of the index battered in the current market downturn.

What companies are included?

There are currently 46 companies in the All Technology Index. These include 40 Australian companies, 3 based in New Zealand, 2 in the United States, and 1 from Ireland. Twenty of these were considered 'unicorns' (valued at over $1 billion) when the index debuted.

The top 10 ASX technology shares in the index are:

Company |

Description |

|

Xero Limited (ASX: XRO) |

A small business accounting software provider headquartered in Wellington, New Zealand. |

|

Computershare Limited (ASX: CPU) |

Provides share registry services and is based in Melbourne. |

|

Afterpay Ltd (ASX: APT) |

Australia's best known buy now, pay later provider, headquartered in Melbourne. |

|

REA Group Limited (ASX: REA) |

A digital advertising company specialising in real estate and home loans and based in Melbourne. |

|

Altium Limited (ASX: ALU) |

Provides software used to design printed circuit boards and is based in San Diego in the United States. |

|

Carsales.com Ltd (ASX: CAR) |

Owns online marketplaces for vehicle sales, headquartered in Melbourne. |

|

WiseTech Global Ltd (ASX: WTC) |

Cloud-based logistics software provider based in Sydney. |

|

Link Administration Holdings Ltd (ASX: LNK) |

Provides data management, analytics, and administration services to the superannuation industry from its headquarters in Sydney. |

|

NEXTDC Ltd (ASX: NXT) |

A data storage company based in Brisbane. |

|

Appen Ltd (ASX: APX) |

Provides training data for machine learning and artificial intelligence headquarter in Chatswood, NSW. |

Other notable inclusions are:

Company |

Description |

|

Bigtincan Holdings Ltd (ASX: BTH) |

Sells sales automation and enablement software. |

|

Domain Holdings Australia Limited (ASX: DHG) |

A property marketing group. |

|

EML Payments Ltd (ASX: EML) |

Partnered with Visa and MasterCard to offer prepaid cards used for everything from gambling to salary packaging. |

|

Kogan.com Ltd (ASX: KGN) |

Online consumer technology retailer. |

|

Nearmap Ltd (ASX: NEA) |

Blends aerial photography with artificial intelligence. |

|

Pro Medicus Limited (ASX: PME) |

Provides software supporting medical imaging and accounting. |

|

Webjet Limited (ASX: WEB) |

Online travel booking provider. |

There are some impressive names included in the index, companies that had a combined market capitalisation of more than $100 billion when the index debuted. In the month since, however, many of these ASX technology shares have seen major share price declines.

How have individual ASX tech shares performed?

Xero

The number 1 ASX tech share in the index, Xero, has seen its shares fall 24.75% to $58.75 (as at Monday's close) since the index launched. The New Zealand-based accounting software provider was less likely to be directly impacted by the coronavirus pandemic than many other companies. With many small businesses expected to fold in a coronavirus-invoked recession, however, Xero may see pressure on its customer numbers.

Afterpay

Afterpay has seen dramatic swings in its share price, and is now down more than 75% from its February highs. Having traded above $40 at its peak, the buy now, pay later provider is now trading at just $9.26. On Friday, Afterpay said it had not seen any material impact on its business activity, the timing of instalment repayments, or transaction losses to date.

Afterpay's service "promotes budgeting by responsible customers," CEO Anthony Eisen said. "[W]e believe the appeal of Afterpay as a disciplined budgeting tool will not be diminished and may be enhanced with changing market conditions," he added.

Nonetheless, if a recession eventuates, spending will be crimped regardless of the method by which people choose to pay.

Webjet

Webjet has seen perhaps the most direct fallout from the coronavirus crisis, with bookings plummeting as governments have continued to tighten travel restrictions. The Webjet share price is down 70% since the index launched with the company in a trading halt since last week. Yesterday it requested its shares be suspended from official quotation, as it works on the terms of a proposed capital raising.

Prior to its suspension, Webjet had withdrawn earnings guidance warning of a material escalation in cancellation rates and reduction in overall travel booking activity. The company had initiated a cost reduction program which was expected to save $10 million over the remainder of FY20. The managing director and board of directors had also voluntarily agreed to reduce their salaries and fees by 20%.

WAAAX shares

As at yesterday's close, WiseTech, Altium, and Appen, which together with Xero and Afterpay make up the formerly mighty WAAAX shares, had fallen 59%, 42%, and 36%, respectively, from their February highs. WiseTech was hit early as the coronavirus epidemic in China slowed global supply chains, resulting in lower demand for logistics operations.

Kogan

Kogan shares have held up fairly well since the index launch, falling a relatively minor 21.7% as at Monday's close. Companies such as Kogan have seen a run on products that will allow people to work from home and manage self-isolation, including computer monitors and freezers. While the online retailer anticipated risks to supplies from China, with coronavirus infections dropping in the country supply chains should not be unduly delayed.

What does the future hold for the All Technology Index?

There's no doubt it's been a rocky start for the Index, however, it still serves an important purpose. In the 3 years prior to its launch, the S&P ASX 200 annualised total return has been around 10%. Over the same period, the ASX 200 tech companies returned over 20%. An economic recovery could see it deliver similar returns once the coronavirus pandemic passes.

The number of technology stocks listed on the ASX has more than doubled in the last 5 years, from 100 to over 200. As and when markets begin to normalise, the index will make it easier to track the performance of the Australian tech sector and bring more attention to smaller listed tech companies. It may also encourage overseas based technology companies to list in Australia, further boosting the country's technology credentials.