A lot of investors look to blue-chip shares thanks to their perceived defensiveness and security. However, being blue-chip or large cap does not mean a company and its valuation cannot hit tough times.

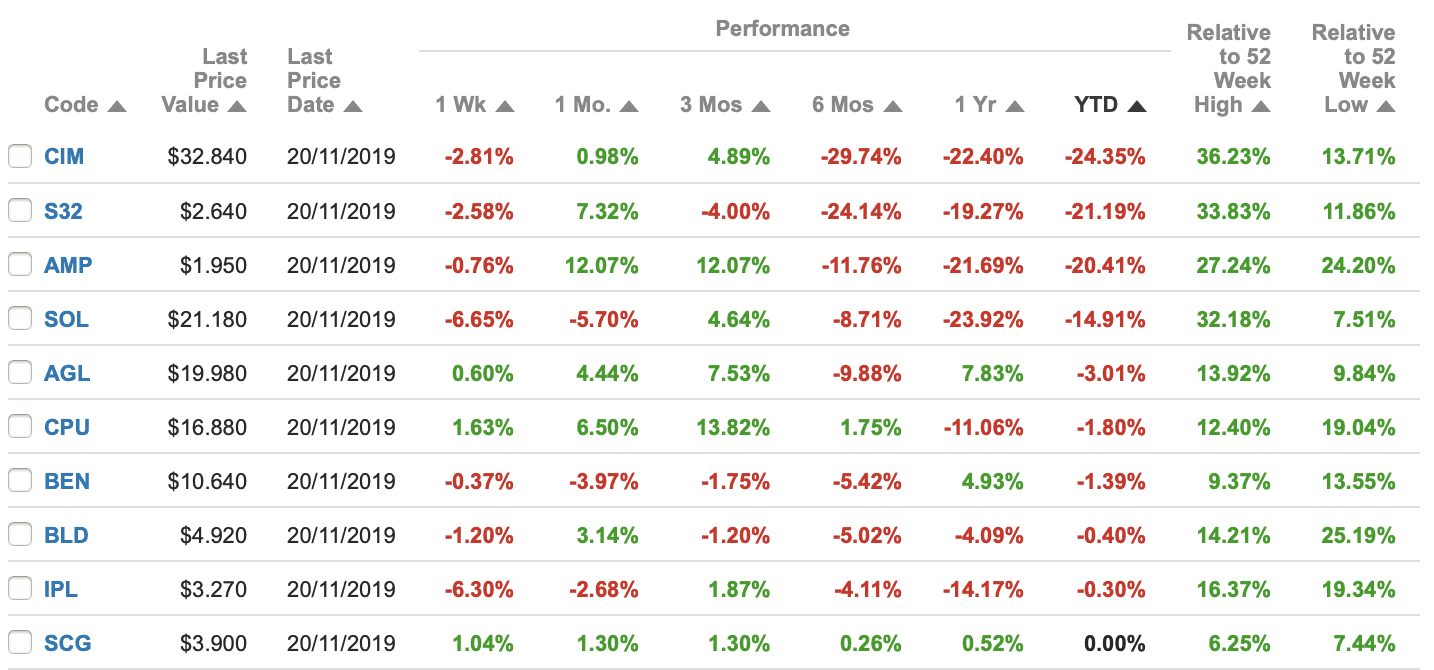

All 10 of the below businesses have produced share price falls over 2019.

It's possible 2020 sees more declines.

As an investor if you own a company falling in value over a period of say 12 months or more it's important to consider whether the valuation is falling due to structural issues or more one-off problems that the company might be able to fix.

If permanent or structural issues are the problem you should probably think about selling your shares. If the problems look more temporary it might be worth hanging tough.

Keeping this in mind let's consider the 10 worst performing large-cap shares of 2019 according to Commsec.

Source: Commsec, November 21, 2019.

Cimic Group Ltd (ASX: CIM) is down 24 per cent in 2019 largely thanks to a profit report for the six months to June 30 2019 that disappointed the market. The group is guiding for net profit between $790 million to $840 million over calendar 2019 and will need to deliver a much stronger second half to hit guidance.

South32 Ltd (ASX: S32) has given up 21% in 2019 after a strong run between 2016-18. This goes to show how the miner is reliant on commodity price strength to maintain profit growth. This year's falls are no shock given its strong prior run.

AMP Limited (ASX: AMP) is still reeling from the Royal Commission and its findings that it charged dead customers fees among other serious issues. The group is attempting to sell underperforming assets as part of a major restructure and turnaround plan. The shares have been in reverse for many years now.

Washington Soul. Pattinson & Co. Ltd (ASX: SOL) is down 15% but is a usually reliable performer for investors thanks to the investment conglomerate's impressive track record of profit and dividend growth. It's probably struggled this year after major holding TPG Telecom Ltd (ASX: TPM) had its merger with Vodafone Australia knocked back by the ACCC.

AGL Energy Limited (ASX: AGL) is down 3% and had a very strong share price run prior to 2019. It's guiding for net profit between $780 million to $860 million over FY 2020 and offers investors reliable cash flows and yield.

Computershare Limited (ASX: CPU) also had a strong share price run from 2016 to 2018 with its stock treading water this year. It actually has a second-to-none track record of long-term growth since listing on the ASX in 1994 at a market value of just $36 million.

Bendigo & Adelaide Bank Ltd (ASX: BEN) has hit some headwinds on the back of falling demand for mortgages and as the wider economy slows in 2019.

Boral Ltd (ASX: BLD) has disappointed investors with softer-than-expected results that it blamed on soft housing construction growth in the U.S. and Australia.

Incitec Pivot Ltd (ASX: IPL) blamed floods in North Queensland and a total of $140 million in 'one off' costs for hurting its FY 2019 results. The stock is marginally lower this year and way behind the market.

Scentre Group Ltd (ASX: SCG) is the ANZ Westfield operator that has suffered from weak sentiment as the founding Lowy family sell down. The growing popularity of online shopping and Australia's weak retail environment is not helping sentiment either. Still the stock offers reliable dividends and cash flows.