The Splitit Ltd (ASX: SPT) share price is up 10% to $1.07 today after the buy-now-pay-later (BNPL) provider reported an operating cash outflow of US$6.9 million on sales of US$466,000 for the quarter ending September 31 2019.

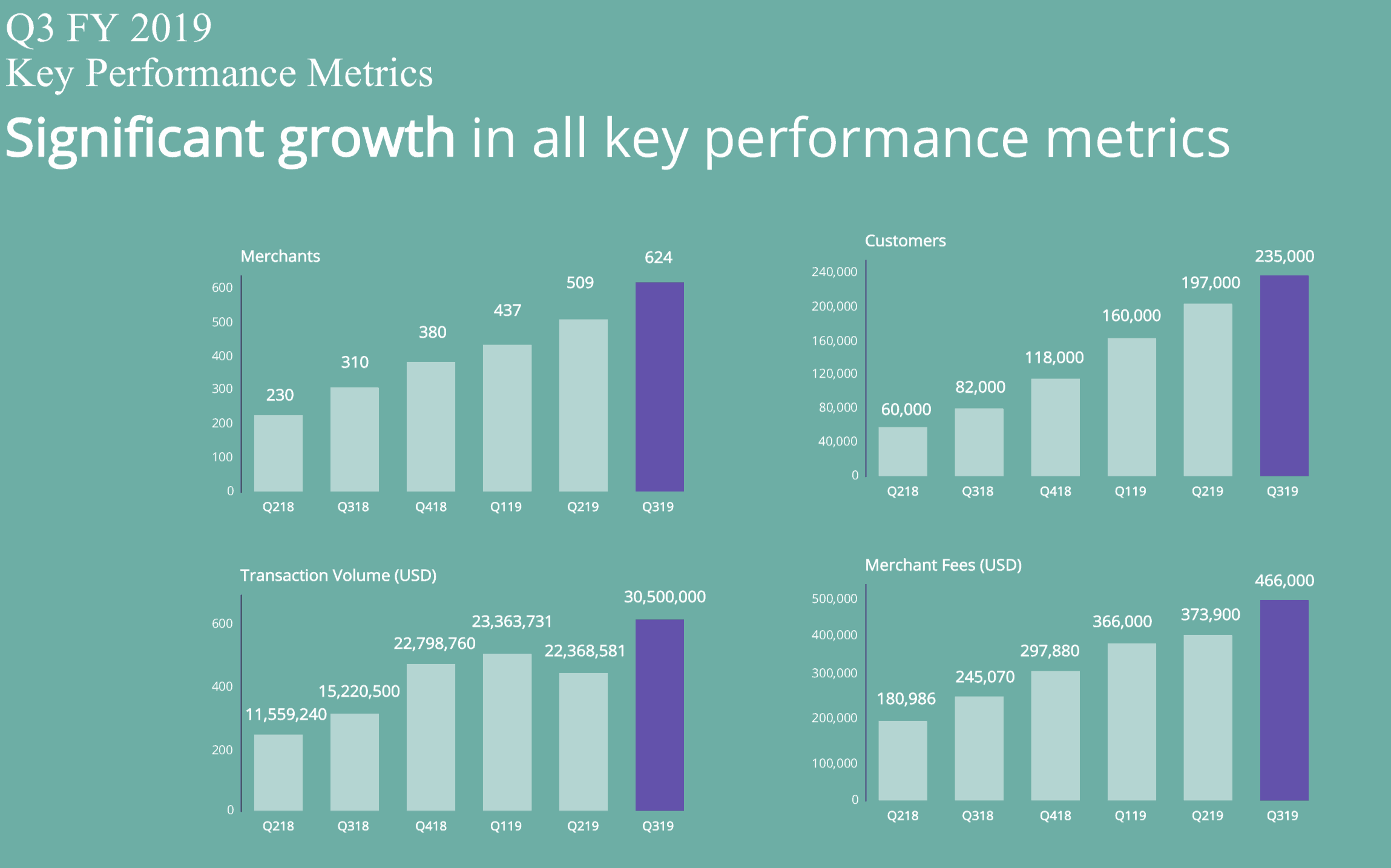

Investors are probably prepared to shrug off the cashflows for now given Splitit is in a race to grab market share in the disruptive BNPL space. It also has a decent balance sheet with US$16.15 million cash on hand. The tables below summarises its growth since Q2 FY 2018.

Source: Splitit investor presentation October 29, 2019.

The core problem for Splitit is that its growth rates are nowhere near as robust as rivals Afterpay Touch Group Ltd (ASX: APT), Z1P Co Ltd (ASX: Z1P) or Sezzle Ltd (ASX: SZL).

Splitit's growth is starting to accelerate, but only off a small base and its underperformance versus rivals is most likely due to marketing capabilities and product offering in a competitive space.

One way Splitit differentiates itself from rivals is in offering monthly versus fortnightly payments. However, it's yet to be shown this is an advantage.

While it also signed a partnership with e-commerce giant Shopify Inc. over the quarter, with how that deal flows through to the December quarter's results an important tipping point for investors.

Given the excitement and FOMO around the space I wouldn't be surprised to see Splitit shares get bid higher, but I wouldn't suggest buying them. For now Sezzle is delivering stronger growth than Splitit. While a better bet in the space is AfterPay as in investing over the long term it often pays to go with the 'lead husky'.