One way to find stock ideas is to use a screen to look for companies that have performed well over the past year. In theory shares performing well in the mid-cap space should still have plenty of room to grow, while not being so small that they remain in the speculative, casino, or 'high-risk' bucket.

Generally then mid-cap shares could offer growth-oriented investors the best risk-adjusted returns and potentially be the blue-chips of tomorrow.

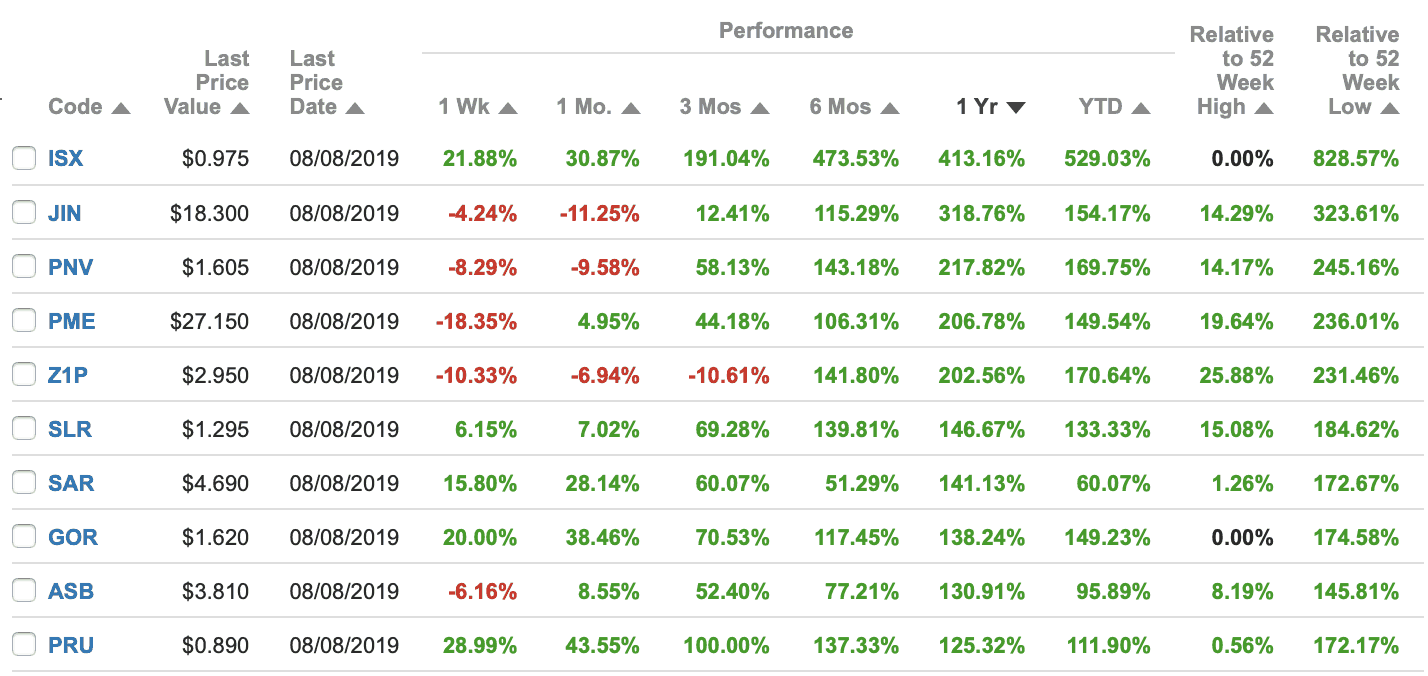

So let's take a look at what Commsec has as the 10 best performing mid-cap shares over the past year as at August 9, 2019.

Source: Commsec, Aug 9, 2019.

iSignthis Ltd (ASX: ISX) is a digital ID verification software business that yesterday announced it has signed a licensing agreement with US payments giant Visa Inc. in the Asia Pacific region.

Jumbo Interactive Ltd (ASX: JIN) is an online lotto business that operates ozlotto.com among other platforms. It is growing sales and profits as punters shift to buying tickets online, rather than over-the-counter at their local shop.

Polynovo Ltd (ASX: PNV) is a medical device and research company that on August 1 reported sales for the 3 months to June 30, 2019 were $3.9 million on a revenue run rate of $15.9 million.

Pro Medicus Limited (ASX: PME) is a healthcare imaging software business that is growing its margins and revenues at a rapid clip. This is translating into strong profit growth with a decent outlook going forward.

Z1p Co. Ltd (ASX: Z1P) is the buy now, pay later business that is growing strongly in Australia as consumers switch to it from credit card services that incur interest payments on debt.

Silver Lake Resources Limited (ASX: SLR) is a gold producer and explorer that is rocketing as gold price soars to around a post-GFC high Aussie dollar high around A$2,230/oz.

Saracen Mineral Holdings Limited (ASX: SAR) is also a gold producer that's seeing its profit margins soar as the US$ gold price lifts.

Gold Road Resources Ltd (ASX: GOR) is another gold winner amongst the mid caps.

Austal Limited (ASX: ASB) is the shipbuilder benefiting from a number of contract wins from the US navy. For FY20 it's now forecasting EBIT of $105 million, compared to a forecast for $92 million in FY19.

Perseus Mining Limited (ASX: PRU) is another gold miner with US$119 million cash on hand as at June 30, 2019.