The S&P/ASX200 Consumer Staples Index (ASX: XSJ) has risen just 4.03% so far this year as many of its big-name constituents see their share prices crash lower – so is the sector undervalued or is it time to get out?

What's been the drag on performance?

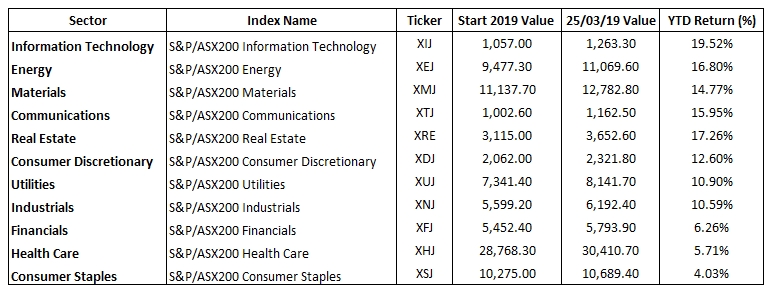

Given the broad S&P/ASX200 Index (ASX: XJO) is up 10.2% this year, its clear that the Consumer Staples sector has been underperforming both the broader ASX and the 10 other major indices.

Many of the hottest dairy stocks are in Consumer Staples including The A2 Milk Company Ltd (ASX: A2M) and Bellamy's Australia Ltd (ASX: BAL) which have shot 28% and 42% higher so far this year.

The Consumer Staples segment also contains some of the biggest retailing names on the ASX including Woolworths Limited (ASX: WOW) and Coles Group Ltd (ASX: COL). The two major Aussie supermarkets have been a minor drag on performance as their share prices have returned -0.09% and 4.29% so far this year, respectively.

But the biggest drag for the sector remains in a few key names that have seen their share prices hammered in recent months. These include the likes of Elders Ltd (ASX: ELD), Blackmores Ltd (ASX: BKL) and Costa Group Holdings Ltd (ASX: CGC), which are down 19%, 30% and 24% so far this year on reduced growth forecasts and weak earnings results.

So, is the sector undervalued or will it slide further?

I think based on the trend so far this year, things are likely to get worse for the Consumer Staples sector before they get better. With the dairy producers excepted, its been a pretty bleak start to the year from a growth and profitability perspective for the sector and I'd be waiting to see what happens in full-year earnings before jumping in.

After yesterday's sharp market decline on economic growth and recession concerns, the traditionally non-cyclical Consumer Staples could offer a good defensive hedge for your portfolio over the next 12-18 months but I'd be keeping my powder dry until then.

For those who are looking for more immediate growth, I'd check out this buy-rated stock which has been tipped to surge higher in a new and growing $22 billion industry.