Bring on the market correction! The S&P/ASX 200 (Index:^AXJO) (ASX: XJO) index hasn't been this cheap in three years and the weakness in share prices of quality stocks won't last long.

There's something for everyone from the sell-off in terms of buying opportunities for growth and income stocks – although there's one sector that stands out.

This sector is resources with the BHP Billiton Limited (ASX: BHP) share price and Rio Tinto Limited (ASX: RIO) share price pull-back offering enticing options that would satisfy dividend hungry and growth seeking investors.

If you aren't already overweight on the sector, you should be. Don't be put off by the fact that the sector has outperformed strongly over the past two-and-a-half years as there's still fuel left in the tank even as the prices of many commodities retreated amid the escalating trade war between China and the US.

UBS isn't concerned as it believes demand for commodities should rise as the Chinese government unleashes an infrastructure stimulus program to offset its economic slowdown from the trade war.

Meanwhile, capital expenditure from global miners has halved from around US$140 billion in 2012. This suggests we won't be seeing much of a ramp-up in the supply of commodities for a while yet.

"A unique aspect of this cycle has been the AUD, with the undervaluation of the AUD relative to commodity prices now the most extreme since the GFC," said UBS.

"This has seen the AUD act as a strong profit tailwind and if the AUD/USD declines to 67c it could boost $A resource earnings by 14%. There also continues to be a heightened focus on costs & productivity, with real unit costs for RIO & BHP now down at levels last seen in 2005."

What all these add up to is cash flow. Profits from miners were forecast to keep growing while their boards remain reluctant to spend big on expansion.

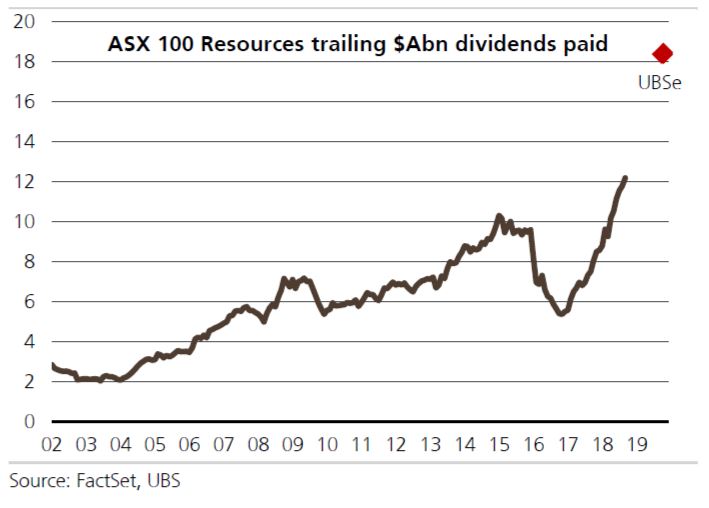

This means the sector is well placed to splash the cash with shareholders and UBS believes these stocks are now offering around a 10% "true yield" (before franking) over the next year with around $19 billion in dividends and at least $11 billion in share buybacks expected.

Big Cash Back: UBS estimates a 52% increase in dividends over the next 12-months

"Valuations also remain below average & earnings are cum-upgrade at spot prices," said the broker. "We prefer the bulks over base metals on better cash flow & less trade war exposure."

The stocks it prefers include BHP, Whitehaven Coal Ltd (ASX: WHC) and Woodside Petroleum Limited (ASX: WPL).

But resources aren't the only attractive stocks in town. The experts at the Motley Fool believe there are good opportunities in other sectors and they've picked their three best blue-chip stocks (outside of resources) for FY19.

Follow the free link below to find out what these stocks are.