Credit Suisse has published its annual Global Wealth Report. Global wealth has increased by US$14 trillion to US$317 trillion, representing growth of 4.6%, according to the investment bank.

Australia can boast of having the highest level of median wealth per adult, at US$191,453. Go Aussies! Switzerland now sits at second place with US$183,339 per adult, although it still has the highest mean average wealth.

Median wealth per adult for the UK was US$97,169 and for the US was US$61,667. The average Australian is far wealthier than a British or American citizen.

You may be sitting there not feeling like some of the wealthiest on the planet. However, homeowners have seen a huge increase in wealth and nearly all of us are benefiting from growing superannuation balances.

Credit Suisse Australia chief investment officer Andrew McAuley is quoted by the AFR as saying "I think Australians don't pay enough attention to superannuation. They notice their house prices going up and down but they are not factoring in that their superannuation is growing quite nicely and that's what report captures."

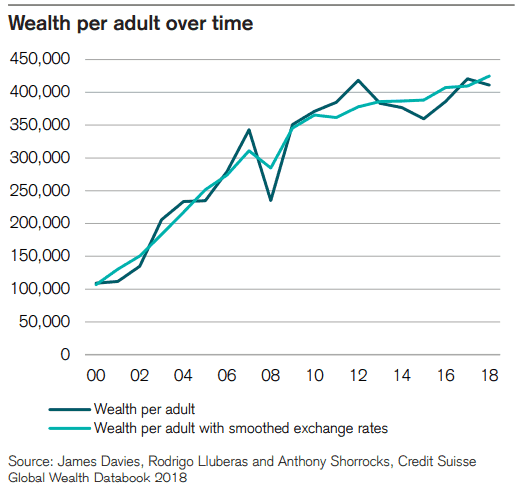

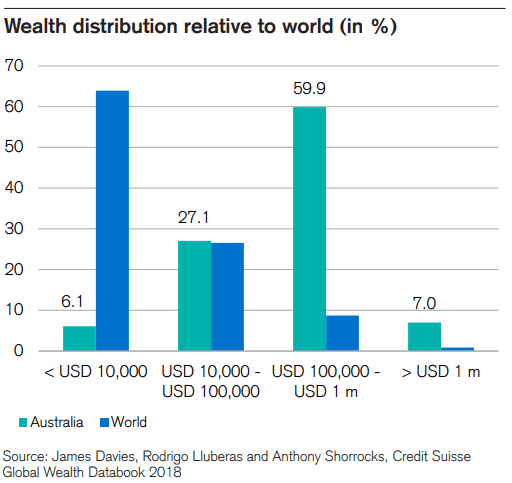

Credit Suisse included two very interesting graphs. The first shows how Australian wealth per adult has grown over the past two years. The second graph shows that a large percentage of Australians fit into the 'middle class' wealth of US$100,000 to US$1 million compared to the rest of the world.

Australia's long-term economic growth is record breaking and has been a bonanza for Commonwealth Bank of Australia (ASX: CBA), Wesfarmers Ltd (ASX: WES), Scentre Group (ASX: SCG), Suncorp Group Ltd (ASX: SUN) and many others.

Foolish takeaway

As long as Australia's property prices and superannuation balances hold up then Australia is likely to remain among the wealthiest. Businesses that cater for older wealthy Australians could be worth watching in the coming years.