In morning trade the Appen Ltd (ASX: APX) share price has been a strong performer and is up 7% to $15.12 at the time of writing. At one stage its shares were as much as 13% higher to an all-time high of $16.00.

Investors have been fighting to get hold of Appen's shares after the global leader in the development of high-quality, human annotated datasets for machine learning and artificial intelligence released its half year results.

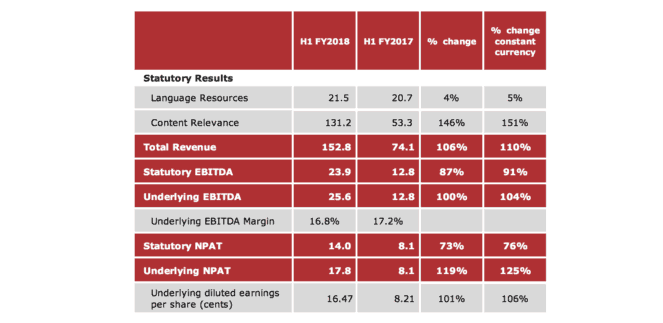

For the six months ended June 30 Appen achieved revenue of $152.8 million, underlying EBITDA of $25.6 million, and underlying net profit after tax of $17.8 million. This was an impressive increase of 106%, 87%, and 119%, respectively, on the prior corresponding period. While the company's top line was given a boost from the acquisition of the Leapforce business, organic revenue growth was still a solid 47%.

As you can see above, the key catalyst of its growth in the first half of FY 2018 has been its Content Relevance segment. Revenue surged 146% compared to the prior corresponding period to $131.2 million, accounting for almost 86% of its total revenue now. The strong result was driven by the Leapforce acquisition and organic growth generated by the expansion of work from current customers. Pleasingly, segment margins widened from 16.8% to 21.7% as the company benefitted from its scale and automation.

This offset another soft performance from its Language Resources segment. However, management expects a project uptick in the second half fuelled by the technology sector, multiple data types, and various applications.

Appen's chairman, Chris Vonwiller, appears to be very positive on the company's prospects. He believes the company is well positioned in the high growth artificial intelligence market, with the benefits of scale and global coverage.

In addition to this, he reiterated Appen's committed to maintain its role as a world leader in the development of high-quality, human annotated datasets for machine learning and artificial intelligence.

Outlook.

The strong first half led to management upgrading its underlying EBITDA guidance for FY 2018 to between $54 million and $59 million, based on the AUD/USD cross averaging 80 U.S. cents. Previous guidance had been for earnings to be at the upper end of its $50 million to $55 million guidance range.

Should you invest?

I think that Appen is one of the best tech shares on the Australian share market alongside the likes of Altium Limited (ASX: ALU) and WiseTech Global Ltd (ASX: WTC). However, like its two industry peers, I do feel that Appen's shares are fully value now.

Because of this, I would only buy Appen's shares if you were prepared to hold on for the long-term.