Given the S&P/ASX200 index recently hit a new 10-year high of 6,248 points on June 21, it seems the domestic stock market is looking healthy.

But with the main contributors to the index, the big 4 banks, performing poorly so far in 2018, one begins to wonder where the index's recent outperformance has come from?

Over the past year, the ASX200 has gained 7.9%. Meanwhile, big bank shares such as Commonwealth Bank of Australia (ASX: CBA), and National Australia Bank Ltd (ASX: NAB) have shed 14.3% and 16.7% from their 52-week highs respectively.

With the big 4 banks making up approximately 24% of the index (according to BetaShares), it usually takes outperformance from the banks to significantly move our index higher.

In order for the index to move higher against this strong headwind others will need to contribute some seriously big gains.

The recent underperformance of the banks is most likely due to the Financial Services Royal Commission, as investors speculate on the effect of recommendations by Justice Hayne on future bank profits and dividends.

This has institutions and retail investors selling the banks and rotating their money into other stocks.

One driving force for the index has been the resources sector. BHP Billiton Limited (ASX: BHP) and Rio Tinto Limited (ASX: RIO), have gained 47.6%, and 35.2% respectively over the last year.

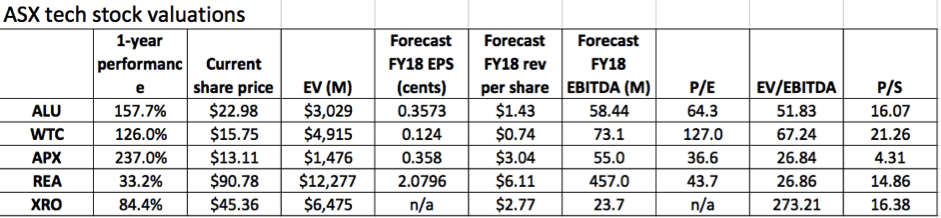

I would argue an equally strong driving force has been the massive gains by lesser known medium-cap ASX tech stocks such as Altium Limited (ASX: ALU) (157.7%), Wisetech Global Ltd (ASX: WTC) (126%), Appen Limited (ASX: APX) (237%), REA Group Limited (ASX: REA) (33.2%), and Xero Limited (ASX: XRO) (84.4%).

Each of these fives stocks have smashed the market over the last year. They do not have as large weightings on the index as the big banks, but when the gains are this big, they will influence the index.

"Great, let's just buy the Aussie tech stocks then" I hear you say, but unfortunately investing is not that simple. Investing returns are determined by the future performance of a business, but unfortunately looking in the rear-view mirror does not help us in this regard.

Not only is the performance of the company important, but also the price you pay to buy the shares.

If the company performs well going forward, but that has already been factored into the share price at the time of purchase, then your returns will not be significant.

Because of the stellar performance of the Aussie tech shares of late, valuations have potentially become over-stretched. If this is the case, future returns could be much lower, or even negative, as the market re-rates the companies to more realistic valuations.

Below I have included a table of some basic valuation ratios for the aforementioned companies, based off the most recent guidance provided by management.

These numbers scream expensive on nearly all of the traditional valuation metrics.

However, these are new age businesses with with extremely attractive economics. Businesses of this quality they deserve to trade at a premium. How big of a premium though, is the all-important question that can be difficult to answer.

Personally, I think shares in Altium and Wisetech are too expensive to garner long-term outperformance. If I held these in my portfolio I would definitely look to reduce my exposure.

That's not to say the share price of these companies will not increase in the near-term.

Momentum trading can do extraordinary things. Short-term trading is a high-risk way to play the stock market though, and you can easily be caught out and suffer massive capital losses.

Over the long-term returns are determined by the price you pay and the performance of the business.

I would say that REA Group and Appen are both holds at these levels, and the only company I would be comfortable buying at these prices is Xero.