On Tuesday the Australian Bureau of Statistics released its tourism data for the month of March.

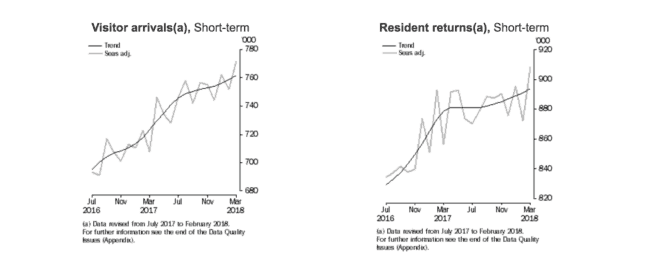

As well as revealing yet another increase in short term arrivals, the data showed that an increasing number of Australians are traveling overseas.

During the month of March 893,900 residents returned to Australia after short-term trips, an increase of 1.7% on the prior corresponding period.

As you can see below on the right, this is continuation of a positive trend.

In light of this, I think the travel industry could be a great area of the market to invest. But which shares should you buy today?

Corporate Travel Management Ltd (ASX: CTD)

I think this corporate travel management specialist would be a great long-term investment option. FY 2018 has been another positive year for the company and management appears confident that it is on track to hit the top end of its guidance. This would mean year-on-year EBITDA growth of approximately 27.5%.

Flight Centre Travel Group Ltd (ASX: FLT)

Flight Centre's shares have been on a stellar run over the last 12 months, rising a remarkable 68%. Unfortunately, I think the days of Flight Centre being a bargain buy are long gone and that its shares are about fair value now at 23x estimated forward earnings.

Qantas Airways Limited (ASX: QAN)

Like Flight Centre, the Qantas Airways share price has been on a tear since this time last year. During this time the airline's shares have risen over 30%. I think this rise was more than justified after Qantas Airways delivered an impressive set of results. However, they are starting to look close to fair value now, so I would suggest investors hold out for a pull back.

Sydney Airport Holdings Pty Ltd (ASX: SYD)

Sydney Airport is arguably one of the best options in the travel industry due to its positive exposure to both the inbound and outbound tourism booms. While I do have slight concerns that it could get caught up in a bond proxy selloff, I remain confident that its positive earnings and distribution growth outlook will prevent this from happening.

Webjet Limited (ASX: WEB)

My first pick in the travel industry right now would have to be Webjet. With tourism growing strongly and consumers shifting to online booking, I expect Webjet to profit greatly. Especially given how the company continues to experience bookings growth at many times the rate of the rest of the market. While 30x estimated forward earnings means its shares could come under pressure if it fails to deliver on expectations, I feel confident in management's ability to deliver on its medium term growth targets.