In morning trade the Super Retail Group Ltd (ASX: SUL) share price has surged after the retailer provided the market with a trading update ahead of its presentation at the Macquarie Group Ltd (ASX: MQG) Australia conference.

At the time of writing the Super Retail share price is up 10% to $7.70.

What was in the update?

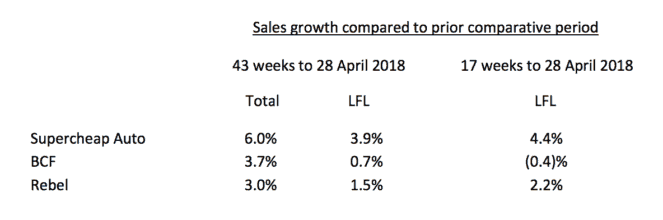

Super Retail provided a sales performance update on its three key brands for the 17 weeks to April 28. Sales have been as follows:

As you can see above, like-for-like sales have accelerated for its Supercheap Auto and Rebel brands during the period. This has lifted year-to-date like-for-like sales growth to 3.9% for Supercheap Auto and 1.5% for Rebel.

Acting as a drag once again has been the BCF brand which has seen a deterioration in like-for-like sales over the last three months. This has reduced its life-for-like sales growth to 0.7%.

The company has blamed BCF's weak sales performance on the impact of differing weather conditions across the country during February and March.

Pleasingly, this hasn't weighed on the company's overall profit growth. Management has advised that company profit growth is in line with expectations thanks largely to the Supercheap Auto brand.

Its earnings before interest and tax (EBIT) margins has remained in line with the prior corresponding period, whereas Rebel's EBIT margin has fallen 0.1 percentage point and BCF's EBIT margin is 1 percentage point lower.

In addition to this, management advised that the recently acquired Macpac business is expected to contribute around $5 million to company EBIT in FY 2018 after completing on April 5.

Should you invest?

Based on this update and its current sales growth, I expect Super Retail to deliver on expectations and achieve earnings per share of approximately 70 cents in FY 2018.

If this proves to be the case then Super Retail's shares are changing hands at a lowly 10x forward earnings today.

While I do have concerns over its Macpac acquisition and would have preferred the company to dump its BCF business instead of adding to it, the current share price does appear to offer investors a compelling risk/reward.

While I would sooner choose Bapcor Ltd (ASX: BAP) or Accent Group Ltd (ASX: AX1) ahead of Super Retail, it is a tempting option after this update.