Happy New Year! It's that time of the year for fresh beginnings and New Year's resolutions. Whilst many resolutions will involve finances and wealth generation, some investors might not be sure where to start.

Here is how I would set myself up to generate wealth in 2018:

- Spend less than you earn and save. It's an obvious starting point and an important foundation to wealth creation. You can earn more by getting a second income (there are many 'side-hustle' blogs and podcasts out there) and you can spend less by cutting out some excess expenses.

- Invest in shares. If you break it down to its simplest element, investing in shares is simply buying a part ownership in a business. Warren Buffett said, "if you buy good businesses at reasonable prices and hold them you are going to make a lot of money and that's true of stocks as a group and it's true of individual companies". Let's break that down:

- Good business. A good business is one that earns a high rate of return on invested capital and ideally is able to reinvest the profit it generates at a good return to enable it to keep compounding those profits. In addition to this, the business will ideally have a competitive advantage (or a 'moat' as Buffett calls it) that allows it to protect its market share and high rate of return from competitors.

- Reasonable price. The idea here is to pay a price that is lower than the value you receive in return. The value of a business is the net present value of all future cash flows that it will generate. There is a lot of judgement involved in estimating this and some key ratios such as Price to Earnings (PE), Price to Book (PB) and Price/ Earnings to Growth (PEG) can be used as indicators of value.

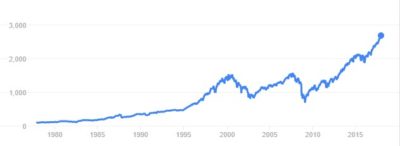

- Hold them. The stock market fluctuates significantly in the short term but can be a good long term value creator. Have a look at a graph below of the S&P500 since 1980 and how it has recovered from dips along the way.

![]()

-

- Stocks as a group. For investors that don't have time to research individual stocks, there are index funds such as Vanguard's US Total share market index referred to in google finance as VUSTOTAL CDI 1:1 (ASX: VTS). Other options are Listed Investment Companies (LICs) which provide investors with instant diversification such as Australian Foundation Investment Co. Ltd. (ASX: AFI) and MFF Capital Investments Ltd (ASX: MFF). MFF was previously managed by Magellan Financial Group Ltd (ASX: MFG) and continues to be run by one of Magellan's co-founders Mr. Chris Mackay.

- Individual companies. Investors with time to research individual companies can look into top companies like Macquarie Group Ltd (ASX: MQG) and Bapcor Ltd (ASX: BAP) or top emerging technologies such as the one below.