The Monash IVF Group Ltd (ASX: MVF) share price fell 7% to $1.55 after the company released its full year annual report this morning. Here's what you need to know:

- Revenues fell 1% to $155.2 million

- Net profit after tax (NPAT) rose 3% to $29.6 million

- Earnings per share grew 3% to 12.6 cents

- Dividends up 3% to 8.8 cents per share

- Net debt grew to $92.5 million (gearing of 56%)

- Monash cycles fell 3.1% while total market cycles fell 0.8%

- Outlook for broadly flat NPAT in 2018 but potential future growth by acquisition

So what?

It was an average result for Monash, with the number of patient treatments declining after four years of consistent growth. Net profit rose primarily due to lower finance expenses this year, although the company also achieved meaningful cost savings in consumables and clinician fees this year. Underlying market share loss may be better than it appears, with Monash stating their belief that most of the market growth in IVF was in the low-cost market, a market that Monash does not participate in.

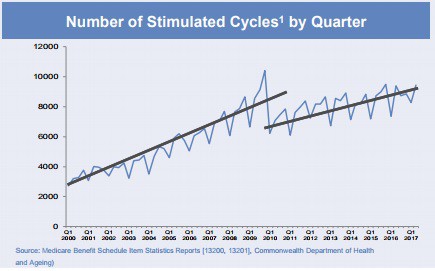

Weak growth in total market cycles this year is also thought to be a hangover from strong growth of 6.8% last year. In the future, Monash expects stimulated cycles to grow at around 3% per annum over the long term, albeit with fluctuations in any given period.

On the plus side, Monash continues to expand with new facilities both in Australia and Malaysia, and may become a larger player in these markets over time. Competitor Virtus Health Ltd (ASX: VRT) also saw its shares fall 1.5% this morning as the market digests Monash's update.

Now what?

Monash carries a fair bit of debt, and its growth outlook is modest. However, the company also has a very modest price tag of ~12x earnings, well below the average for Australian healthcare companies. If demand for IVF proves to be defensive, as looks to be the case, Monash could be a nice performer over the long term.