The Nearmap Ltd (ASX: NEA) share price rose 4% this morning after the company released its annual results to the market. Revenues jumped 32% to $54.1 million, and the net loss after tax was $11 million.

No dividends were declared. Nearmap ended the year with approximately $17 million in cash and no debt.

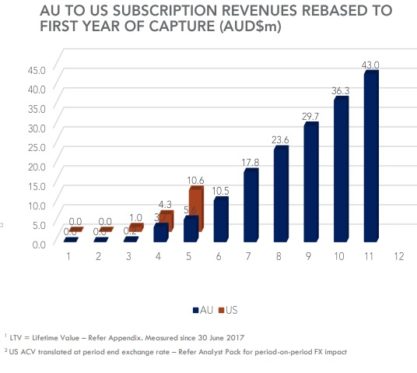

Continued strong growth in both the US and the Australian markets drove Nearmap's business performance during the year, as this chart neatly shows:

As readers can see, the US division is becoming increasingly important, (approximately 20% of Nearmap's revenues) although Australian revenues also continue to grow at around 20% per annum. Pleasingly, customer "churn" (the number of customers that cancel their subscription each year) fell to 7.5%, down from approximately 10% in previous years. Customer churn is important because it is expensive to acquire customers (via marketing). Each year extra that a customer continues for, results in higher financial returns for the company. It is also a useful secondary indicator of whether a company's products are any good, as companies with bad or replicable products will have much higher customer churn.

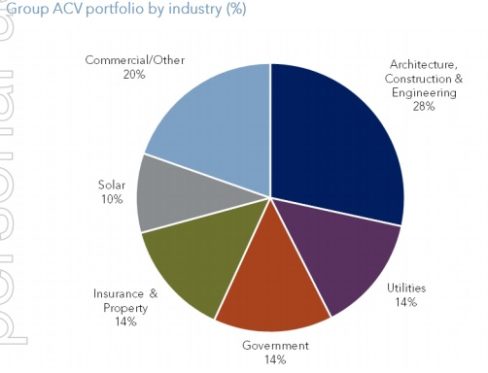

Nearmap also continues to report a diverse list of clientele, reducing the risk of key customer losses or reliance on any particular industry.

With revenue per user continuing to grow, churn decreasing, and total subscription numbers also rising, Nearmap has been able to generate substantial value over the past few years. It is possible that this will continue, especially with new products, continuing innovation, and a strong sales team. However, Nearmap only has around 1.5 years of cash remaining at current burn rates, including operating cash losses and expenditure on investment. As a result, it is likely that the company may need to seek more capital within the next 18 months or so, depending on growth.

Still, Nearmap continues to perform well and I think the company is worth investigating even at today's prices of $1.60 per share.