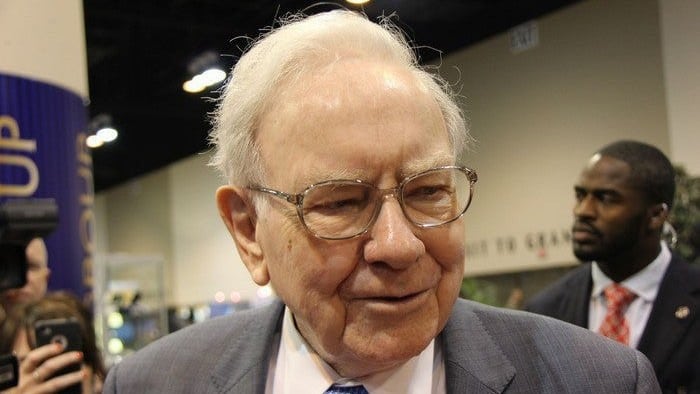

Warren Buffett is one of the world's most successful investors in the world, having built Berkshire Hathaway (NYSE: BRK.B) into a US$1 trillion powerhouse.

While he tends to invest predominantly in US stocks, his principles apply just as well to the Australian market.

So how can everyday investors channel Buffett's mindset when picking ASX shares? Here are the key ideas.

Look for businesses, not tickers

Buffett has always said he buys businesses, not ticker codes. That means thinking like an owner. Would you be comfortable holding this business for the next 20 years?

Companies like ResMed Inc. (ASX: RMD) or Coles Group Ltd (ASX: COL) arguably fit this bill, with business models that are deeply entrenched in healthcare and supermarkets — two sectors with enduring demand.

Seek out competitive advantages

Warren Buffett is famous for seeking companies with a wide moat. This is a lasting competitive edge that protects profits from rivals. This could mean dominant market positions, strong brands, or unique technology.

WiseTech Global Ltd (ASX: WTC) is a good example on the ASX. Its software underpins global supply chains and is costly and complex for customers to switch away from. That kind of stickiness is a classic moat.

Management quality

The Oracle of Omaha often stresses that talented, trustworthy managers are crucial. Investors should look for leadership teams with a track record of smart capital allocation and long-term decision-making.

Macquarie Group Ltd (ASX: MQG) demonstrates this well. Its management has built a reputation for adapting quickly to new opportunities while maintaining shareholder discipline.

Think in decades

Buffett ignores short-term noise, focusing instead on compounding returns over many years. ASX investors can apply the same principle by tuning out daily share price swings and concentrating on the long-term trajectory of earnings and dividends.

The reality is that wealth grows through patience. Even modest annual growth can multiply an investment significantly over a couple of decades.

Fair values

Warren Buffett famously said that it is "far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

For ASX share investors, this means doing the homework — whether by looking at price-to-earnings (PE) ratios, valuation models, or analyst reports — to ensure you are not overpaying for quality.

Foolish takeaway

Thinking like Warren Buffett isn't about copying his every move — it is about adopting his mindset.

By treating ASX shares as real businesses, insisting on sustainable moats and quality management, focusing on decades of compounding, and buying at fair prices, investors can tilt the odds of success firmly in their favour.