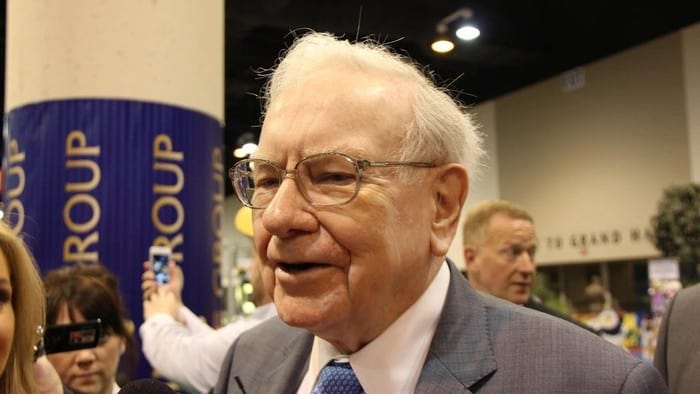

Warren Buffett is widely regarded as one of the greatest investors of all time.

Over multiple decades, the Oracle of Omaha has built a multi-billion-dollar fortune, all while using a strategy that anyone can understand.

With that in mind, here are five easy steps to start investing like Warren Buffett with ASX shares.

Look for moats

Buffett loves businesses with a sustainable competitive advantage — what he often calls an economic moat. These are the traits that protect a company from rivals and help it generate strong returns over time.

On the ASX, shares like ResMed Inc. (ASX: RMD) and CSL Ltd (ASX: CSL) fit the bill. These companies have deep expertise in healthcare, global reach, and trusted products — all of which are hard for competitors to replicate.

Buy what you understand

Warren Buffett avoids businesses he doesn't understand — no matter how trendy they may seem. Instead, he sticks to circles of competence.

For ASX investors, this could mean sticking to familiar sectors like banks, supermarkets, infrastructure, or healthcare. Businesses like Coles Group Ltd (ASX: COL) or Bunnings and Kmart owner Wesfarmers Ltd (ASX: WES) are easier to understand than a speculative biotech startup with no earnings.

If you can't explain in one sentence how a company makes money, it is probably a red flag.

Buy at a fair price

Warren Buffett once said: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

That means valuation still matters — but quality counts more. Don't fall into the trap of chasing the cheapest stocks. Instead, look for great businesses trading at reasonable prices.

For example, Goodman Group (ASX: GMG) may not be dirt cheap, but it is a high-quality company with strong long term growth potential. And with its shares down 14% from their 52-week high, this could be a fair price to pay for a wonderful company.

Think long term

Buffett's favourite holding period is forever. He doesn't jump in and out of positions chasing the latest headlines.

The same goes for your ASX share portfolio. Think in terms of decades, not months. Great companies often reward patient investors through growing earnings, dividends, and capital appreciation over time.

Focus on businesses that can compound earnings over many years — not ones trying to hit quarterly earnings targets.

An ETF short cut

If you're after a hands-off approach, there's one ASX ETF that does a lot of the Buffett-style homework for you: the VanEck Morningstar Wide Moat ETF (ASX: MOAT).

This fund tracks an index of high-quality companies with durable competitive advantages and fair valuations.

It currently includes businesses like Nike (NYSE: NKE), Microsoft (NASDAQ: MSFT) and Walt Disney (NYSE: DIS) — all companies with wide moats and strong fundamentals.

This makes it a simple, diversified way to gain access to high-quality global businesses without needing to pick the winners yourself.

Foolish takeaway

Buffett's strategy isn't about flashy trades or hot tips — it is about timeless principles: buy great businesses, understand what you own, be patient, and stay consistent.

With the right mindset and a focus on quality ASX shares (or a Buffett-inspired ETF), you can start building wealth the Warren Buffett way.