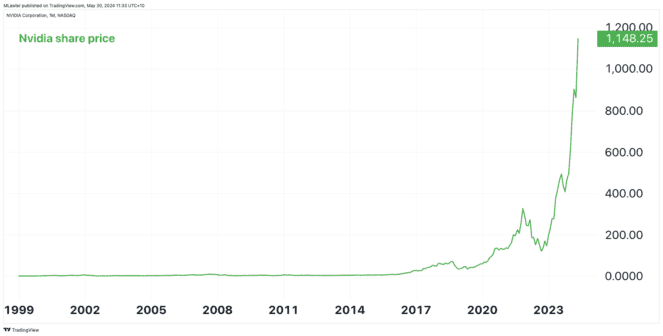

If the share market were a sport, Nvidia Corp (NASDAQ: NVDA) stock would be in the running for MVP of 2024. The computer chip technology company extended its record share price last night, reaching US$1,154.92 before settling at US$1,148.25.

Catapulted by the burgeoning demand for hardware to power artificial intelligence, the US-based graphics card maker has shot up the ranks of most valuable companies. Today, Nvidia is worth US$2.82 trillion, hot on the heels of Apple Inc (NASDAQ: AAPL) and Microsoft Corp (NASDAQ: MSFT) for the number one spot.

Only four short years ago, Nvidia's market capitalisation stood at US$214.5 billion, one-thirteenth of what it is today. With the stock almost tripling in value in the past year alone, I think I'd be better off buying a certain ASX stock instead.

Buffett senses are tingling on Nvidia stock's high

Don't get me wrong… I believe Nvidia is a phenomenal company. Not that it matters from an investment perspective, but I've been on 'Team Green' for GPUs (graphic processing units) since saving enough money to buy my first high-performance gaming computer in 2015.

I toyed with the idea of investing in Nvidia stock many times over the years. In 2018 (up 1,900% since), in 2021 (up 400% since), and in 2022 (up 580% since). Not once did I pull the trigger, opting for Advanced Micro Devices Inc (NASDAQ: AMD) in its place. Betrayal of Team Green, I know.

But now, I can't help but think there's a bit of euphoria surrounding Nvidia.

I get a little nervous when a company's stock price chart looks like the one below. If you're a long-term investor, stock price action shouldn't dictate whether to buy or sell. But it can tell you about investors' mentality and mood.

A timeless quote from the legendary Warren Buffett is, "Be fearful when others are greedy, and be greedy when others are fearful".

It's rare now to hear anything but optimism about the demand for AI and the boost it will generate for Nvidia stock. My inner Buffett is detecting a euphoric vibe among investors. A 'no questioning it, just believe!' frame of mind.

Meanwhile, my mind is contemplating the 'what ifs'…

What if demand for accelerated computing drastically tapers at a point?

What if Nvidia's margins revert back to around 25% instead of its recent 53%?

What if Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM), aka TSMC, lifts prices?

Personally, I think Nvidia's growth is murkier now than it was two or three years ago. And while a 42 times forward earnings multiple mightn't be the steepest ask, I'm not sure those earnings are sustainable.

Relocating the greed to where there's fear

Channelling my inner Buffett again, I'm inclined to invest where fear has engulfed a good company. Often, this provides a greater margin of safety, minimising the downside and increasing the upside.

I genuinely believe Corporate Travel Management Ltd (ASX: CTD) is an ideal current alternative to Nvidia stock. It's a completely different business, providing travel management solutions. However, like Nvidia, it is highly profitable, growing at an above-market rate, and is founder-led.

The difference is that this ASX stock trades at a price-to-earnings (P/E) ratio of 17 times, and its shares are out of favour — down 37% over the past 12 months. Weaker full-year FY24 guidance set the selling into motion on 21 February 2024.

I reckon the fear is overdone.

In my opinion, buying Corporate Travel Management now is more like buying Nvidia stock in 2021 or 2022 before the boom. It may not achieve the same meteoric gains, but I think there is less of a rosy outlook already baked into this ASX stock than Nvidia.