Before we get into the historical price performance of shares vs. property, let's check out the first quarter results of 2024.

Over the period, the S&P/ASX 200 Index (ASX: XJO) rose by 4.03% and hit a new all-time record of 7,848.5 points along the way.

Meantime, the median Australian house price rose by 1.7% to $883,854 and the median apartment price rose by 1.3% to $640,162, according to CoreLogic data.

As always, some individual ASX shares and metro and regional property markets outperformed.

Perth and regional Western Australia remain the hottest metro and regional markets in the country.

The median house price in Perth ascended 5.5% to $735,276 over the March quarter. In regional Western Australia, the median house price lifted 4.7% to $508,513.

Among ASX shares, the best performers included Life360 Inc (ASX: 360) up 73% and Megaport Ltd (ASX: MP1) up 63%. ASX tech share Altium Ltd (ASX: ALU) rose 39% while Paladin Energy (ASX: PDN) lifted 38%. And GQG Partners Inc (ASX: GQG) shares increased by 31%.

Shares vs. property: The long-term performance

For every investor who has grappled with the choice between shares vs. property, we have good news.

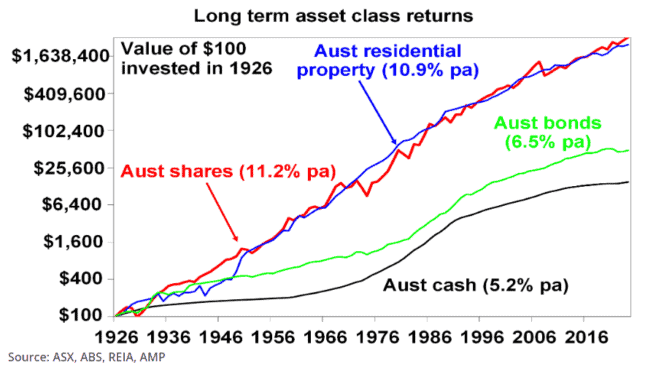

In his latest blog, AMP chief economist Dr Shane Oliver reveals that shares vs. property deliver very similar long-term returns. All up, 11.2% per year for shares and 10.9% for property over nearly 100 years.

Dr Oliver published a chart showing what $100 invested in real estate and shares in 1926 would be worth today (assuming dividends and rent after costs were reinvested along the way).

Source: Oliver's insights: Seven things you need to know about the Australian property market.

As you can see, that $100 would now be worth more than $1.6 million either way you invested.

The chart compares the performance of $100 invested in cash and bonds since 1926 as well.

Oliver comments:

Over the period both shares and property return around 11% pa.

Property's low correlation with shares, lower volatility but lower liquidity makes it a good portfolio diversifier. So, there is clearly a role for it in investors' portfolios.

For further reading, you can check out the most recent 10-year returns of shares vs. property here.

Property price growth predictions for 2024

Dr Oliver says property prices are rising in 2024 because a major chronic undersupply is creating a supply/demand dynamic that is producing rising prices despite rising interest rates.

Historically, rising interest rates have typically caused housing values to fall.

Dr Oliver explains:

Our base case is now for 5% or so home price growth this year, down from 8% last year, as still high interest rates constrain demand and along with higher unemployment lead to some increase in distressed listings.

However, the supply shortfall should provide support and rate cuts are expected to boost price growth later this year.

Delays to rate cuts and a sharp rise in unemployment would signal downside risks whereas the supply shortfall points to upside risk.

Dr Oliver said the key for property investors this year "is to look for properties offering decent rental yields" to offset the impact of high interest rates pushing up mortgage repayments.