Earlier this week I suggested to you three ASX shares that you could invest $500 into right now with a long-term horizon.

I did that to dispel the misconception that many Australians have that only wealthy people get to make money from stocks.

There are no more brokers chain-smoking in front of the telephone, nor traders yelling at each other on the floor of the stock exchange.

Investing in shares has become "democratised" with low fees and almost no barriers to entry.

In that spirit, here are two more top Australian shares to grab now for $500 each, to put away in the bottom drawer:

Resources exposure with a technology bent

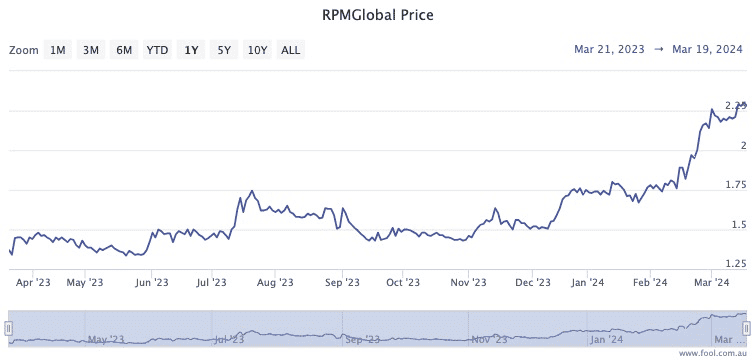

RPMGlobal Holdings Ltd (ASX: RUL) is a technology and tech services provider for clients in the mining industry.

I like this stock because it provides exposure to the resources sector without the vomit-inducing volatility that can come with directly owning shares for mines.

Even though the share price has already rocketed more than 66% in the past 12 months, the analysts at Elvest certainly think the outlook is still bright.

"RPMGlobal indicated that demand for its software was increasing across multiple geographies, which, alongside flattening research and development spend, should drive strong earnings growth in coming periods."

As well as Elvest, the small cap is a strong buy for the teams at Veritas Securities and Moelis Australia.

I think that there is an excellent chance that, in a few years' time, the RPM share price will be much higher than where it is now.

Top Australian shares for online shopping and AI

It's not controversial these days to say that e-commerce and artificial intelligence are boom areas set for years of growth to come.

Industrial real estate manager Goodman Group (ASX: GMG) has been, and could continue to be, a major beneficiary from those themes.

The business develops and leases out massive warehouse facilities, which fancy e-commerce clients like Amazon.com Inc (NASDAQ: AMZN) call "fulfilment centres".

In addition, Goodman has recently identified real estate suitable to host data centres as a huge money spinner, with cloud computing and AI taking off at the moment.

Considering these tailwinds, I am confident that in 2029 the Goodman share price will be well above where it is trading now.