It's a bit of a misconception that you need a massive amount of money to start investing in ASX tech shares.

For one, the share prices on the ASX are not exorbitant like in the US.

Take online travel booking site Booking Holdings Inc (NASDAQ: BKNG) as an example. Those shares are each going for an insane US$3,500 at the moment, which is more than $5,000.

It's rare to see any ASX tech shares trading for more than a couple of hundred dollars, let alone thousands.

So if you have as little as $3,000, you can get started on your journey.

Here are three ASX technology stocks you could invest $1,000 into and be confident it'll be worth significantly more in five years' time:

'Scaling margins and earnings rapidly'

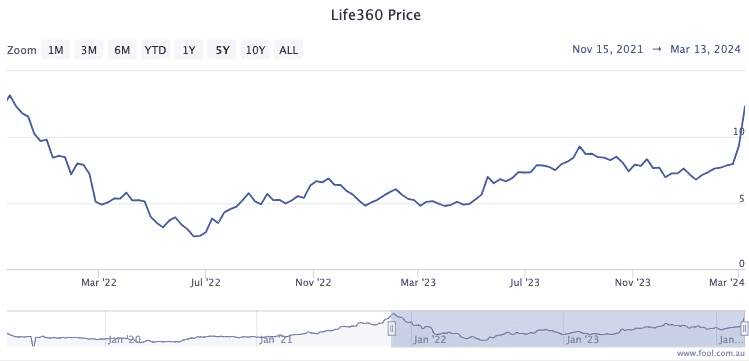

Californian outfit Life360 Inc (ASX: 360) makes an eponymous smartphone app that's now ranked 30th in the iPhone app store, and 5th in the social networking category.

The family security software is proving to be popular among Americans who want to track where their children are. The app can similarly be used to keep elderly folks safe.

Even though the share price has multiplied 5 times since its June 2022 low, experts are lining up to still express their bullishness for Life360.

In fact, seven out of eight analysts currently surveyed on CMC Invest believe the ASX tech stock is a strong buy.

"The company is now scaling margins and earnings rapidly off a low base, with attractive unit economics and potential structural profitability tailwinds on the horizon from a reduction in effective app store fees," said Goldman Sachs Group Inc (NYSE: GS) analysts earlier this month.

New Zealand hero taking on the world

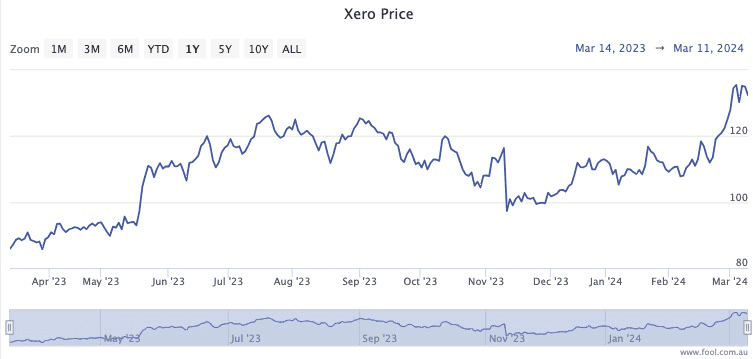

In recent years New Zealand software maker Xero Ltd (ASX: XRO) has been through a similar journey to Life360.

After interest rates rose steeply over 2022 and 2023, it was forced to look at itself in the mirror and change from its profligate ways.

The company cut expenses, which included staff cuts, and dialled down its ambitious expansion targets. Cash flow and profits were elevated in priority.

The reforms have worked in charming the market, with a 57% increase in share price over the past 12 months.

Many experts are betting the upward trend will continue for a while yet, with 10 out of 14 analysts surveyed on CMC Invest still rating Xero as a buy.

ASX tech shares for a business boosting earnings by 785%!

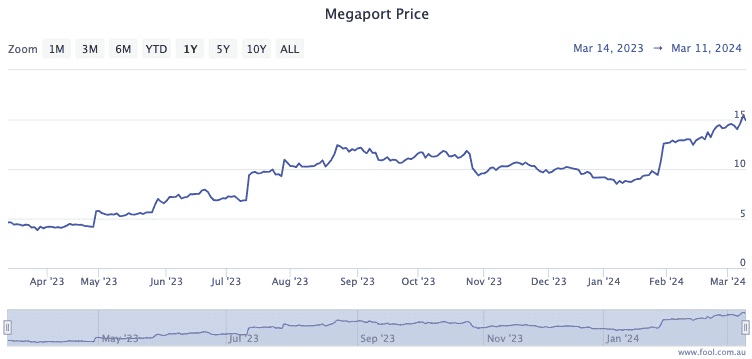

Almost exactly one year ago, Megaport Ltd (ASX: MP1) was in crisis after its chief executive exited without warning.

Maybe insiders knew it was coming but it shocked the market at the time.

Twelve months later, the Megaport share price has more than tripled and all its half-year numbers were impressive:

- EBITDA up 785%

- Revenue up 35%

- Record annual recurring revenue (ARR) 29%

- Gross profit up 43%

With all the data needing to be moved around for e-commerce, cloud computing and artificial intelligence, professional investors are excited for the future of the virtual networking provider.

Ten out of 15 analysts covering Megaport rate the ASX tech stock as a buy, according to CMC Invest.