With the stock market so buoyant over the past few months, bargains are becoming harder to spot.

However, popular lithium stock Core Lithium Ltd (ASX: CXO) is now down more than 18.5% this year. If you go back 12 months, it's been a painful 77% dive.

So is this a cheapie just staring at you in the face?

An endless winter for the lithium industry

It's been a rough year-and-a-half for all stocks related to lithium.

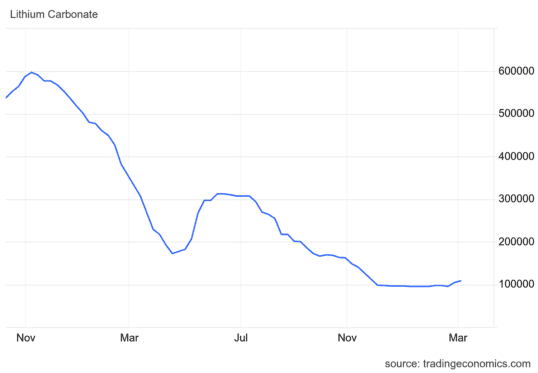

The global prices for the commodity have dived more than 80% as Western consumers lock their wallets after brutal interest rate rises, and the Chinese do the same from shocks in their real estate industry.

So it's no wonder a pure-play producer like Core Lithium has seen its valuation shrink 87% since November 2022.

In the long run, the experts agree that lithium will be in hot demand from all the batteries that need to be made for the electrification of fossil fuel engines.

So when the turnaround comes in the lithium market, it will

But when the turnaround will come for the lithium industry is up for debate.

Only last week, a negative production update from electric car maker Tesla inc (NASDAQ: TSLA) sent Core Lithium shares spiralling down 14% in just 24 hours.

Core Lithium is a miner that's not mining

The other headwind for Core Lithium is that it was forced to stop mining.

Perhaps its larger rivals have the economies of scale to keep going, but in January, the financial equation became unviable for Core to produce.

This is absolutely the right decision to make so that the business is not bleeding cash. But it does give Core Lithium a bleak outlook.

Those who invest for a living are avoiding the miner like the plague.

According to CMC Invest, none of the eight analysts covering Core Lithium are rating it as a buy. Six are recommending investors to sell.

So the answer to the question is that now is probably not the time to buy Core Lithium shares.

Either something in the business or the lithium market will have to change for investors to gain more confidence in its future.