Australia is blessed with a range of quality dividend stocks.

The reason for that is the nation's tax rules, which favour dividends as the method of returning capital to shareholders over other channels, such as buybacks.

Many dividends in Australia come with franking credits, which allow the recipient to avoid paying income tax on that cash because corporate tax has already been levied on it.

The avoidance of double taxation, while not unique to Australia, is a privilege not seen in many comparable countries.

Anyway, back to the stocks themselves.

If you're interested in generating a reliable income, the myriad of choices makes it difficult to figure out which stocks to buy.

To assist with that search, I've picked out four ASX income stocks that I think are looking pretty good right now:

The king among banks and a king of the kings

It would be remiss to not mention ASX bank shares in a conversation about reliable income generators.

Australian banks, regardless of what you think of them as a consumer, pay out decent and consistent dividends throughout the economic cycle.

At the moment, the best dividend yield among the major banks can be found with ANZ Group Holdings Ltd (ASX: ANZ), which pays out 6% that's roughly half-franked.

Check out this consistency:

| Dividend date | Amount |

| Dec 2023 | 94 cents |

| Jul 2023 | 81c |

| Dec 2022 | 74c |

| Jul 2022 | 72c |

| Dec 2021 | 72c |

| Jul 2021 | 70c |

For a stock that pays out a bit more, one can't go past Yancoal Australia Ltd (ASX: YAL).

While resources companies can be notoriously volatile because of global commodity prices, this coal miner managed to hand out a sensational fully franked 11.3% yield even after a lean 2023.

That's almost double the income generated by ANZ.

What's more, the experts are loving the outlook for Yancoal right now. Broking platform CMC Invest shows that all four analysts that cover the stock reckon it's a buy.

The income stocks making money from global demand

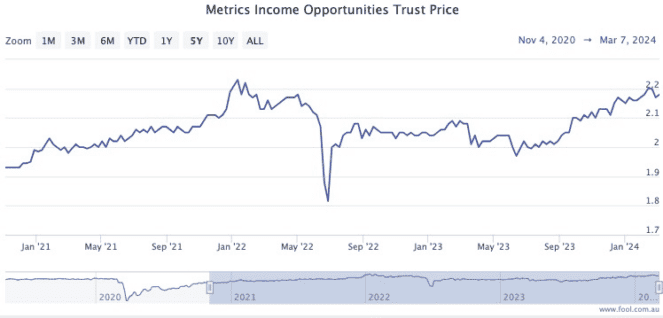

Metrics Income Opportunities Trust (ASX: MOT) puts money into private credit "and other" investment opportunities.

And this stock has an absolutely remarkable dividend habit.

Firstly, it pays out monthly, rather than just twice a year.

Secondly, adding up the past 12 dividends gives it an impressive yield of 9.2%. If you go back the last three years of monthly payouts, the yield is around 8%.

Its critics do point out the nature of the underlying investments is a bit too mysterious for their liking, but Metrics' track record of generating consistent and regular income is indisputable.

Conflicts in Ukraine and the Middle East in recent years have emphasised how traditional energy sources are still needed to keep the lights on while the world builds up its renewable generators.

Woodside Energy Group Ltd (ASX: WDS) is, therefore, in prime position to take advantage of this demand.

Similar to Yancoal, low commodity prices in 2023 meant Woodside didn't necessarily have its best year.

But the Australian company kept paying out dividends as best as it could, to still maintain a yield of 7.1%.