There are two ASX dividend shares that are producing more than 9% yield, pay out income monthly, and have had very little stock price volatility over the past few years.

Sound too good to be true? Believe it or not, such stocks do exist.

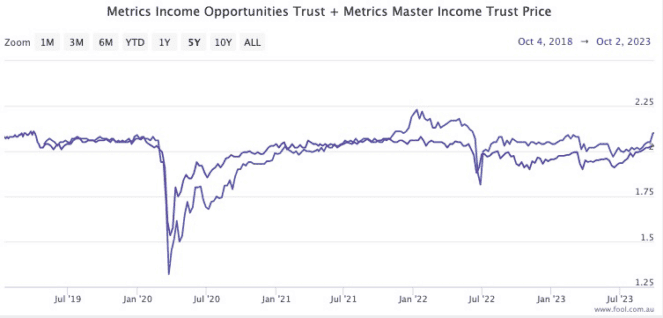

Metrics Income Opportunities Trust (ASX: MOT) and Metrics Master Income Trust (ASX: MXT) have exactly the attributes just mentioned.

They are investment trusts that pay out distributions every month, at 9.38% and 9.08% dividend yield respectively.

The Master Income Trust has been on the ASX since October 2017. Its share price has not varied much from just above $2, save for two short downward spikes during the COVID-19 crash and June 2022.

The Opportunities Trust has been publicly traded from May 2019, and has also consistently kept its price just north of $2.

Protect your capital and rake in 9% income. There has to be a catch, right?

One curious investor asked this very question to Shaw and Partners portfolio manager James Gerrish:

'Delivering consistent monthly income'

Gerrish admitted that his income fund had actually held Master Income Trust but had recently sold.

"Both funds have performed well and have been true to their mandate, delivering consistent monthly income," he said on a Market Matters Q&A.

"We have not considered MOT for many of the same reasons as why we sold MXT."

The trouble with these two shares, for Gerrish's team, is the lack of information on the nature of investments held.

"Investors have low visibility on the positions held within the trust and performance is yet to truly be tested in periods of economic distress.

"MOT also looks to earn capital gains out of debt, banking on improving credit quality or credit spreads, while having a high-performance fee rate if it beats the hurdle which further adds to the risk the trust takes on"

He did acknowledge that Metrics are "great managers" with "a strong track record".

"But we prefer to hold more transparent positions."