Warren Buffett has always advocated that investors should buy businesses at a price that's less than they're worth. I think some Aussie companies look like cheap ASX shares following their recent reports.

I only like to look at businesses I think can grow over the long term, meaning they'll be more valuable in three years or five years than today. With that in mind, when the share prices fall, it seems like a good opportunity for me to buy.

Johns Lyng Group Ltd (ASX: JLG)

The Johns Lyng share price is down 10% since 26 February 2024.

The business specialises in restoring a building and its contents after damage by an insured event, including flooding, storms and fire. It's also growing its presence in the catastrophe work industry.

I saw several things in the HY24 result that cemented my belief it has an exciting future.

Its core business as usual (BAU) revenue rose 13.7% to $426.1 million, though total revenue declined 4% because catastrophe revenue was lower. Core BAU earnings before interest, tax, depreciation and amortisation (EBITDA) rose 28.1% to $55 million and total EBITDA grew 7.5% to $63.9 million – that's good evidence of operating leverage.

The ASX share also reported that its BAU normalised net profit after tax (NPAT) rose 15.8% to $25 million. If this number can keep growing by double-digits (in percentage terms), then the compounding can enable Johns Lyng to generate much bigger profits in the coming years.

I was also pleased to see that the company is continuing to make acquisitions in the strata management space. Not only does this mean it can create consistent, resilient earnings, but it can also unlock synergies with the core business by utilising those services. I think Warren Buffett would be a fan of this business.

In my opinion, this short-term pullback is a good buy-point for this cheap(er) ASX share. I'm planning to buy more Johns Lyng shares next week.

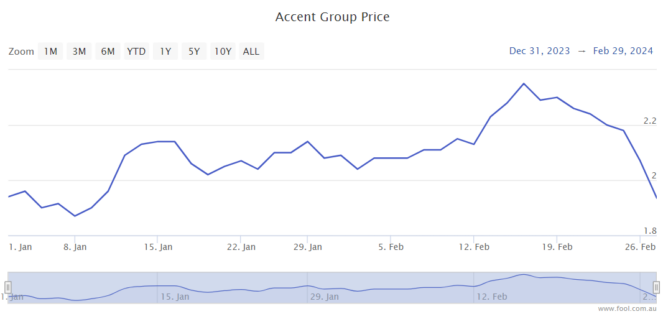

Accent Group Ltd (ASX: AX1)

The Accent share price is down 13% from 14 February 2024.

The business continues to add stores across the brands that it owns as well as shoe brands it acts as a distributor for. In the first half of FY24, it saw a total of 72 new stores added. Accent said 22 new Platypus stores have been opened in Australia and New Zealand, along with 17 new Skechers stores.

The ASX share also saw its contactable customers increase by 0.2 million to 10 million.

It saw its gross profit margin improve from 55.2% to 56.6%, which was enough for the business to report a $2 million increase in its gross profit.

While other profit measures decreased, partly due to the inflation of costs, I think the business has a promising future once retail conditions improve.

Its dividend payment of 8.5 cents per share is still an attractive level of passive income.

The trading update was promising. It said total owned sales in the year to date to the end of January 2024 were up 1.6%, while like-for-like sales for the second half were down just 0.7%. The gross profit margin continues to be above last year, while costs continue to be higher, though at a lower rate of increase compared to the first half.

I'm planning to buy some more Accent shares next week. I think this is a very cheap ASX share.