Could you do with a second income of $24,000 each year?

Who couldn't, right? That's a huge overseas holiday each year, home renovation, or the kids' school expenses taken care of.

It could even allow you to step down to part time work so you can free up time to spend with the family, pursue hobbies, or anything else that might make you happy.

I'm here to tell you that such a flow of passive income is not just a pie-in-the-sky dream. It is within the reach of ordinary Australians.

Here's a hypothetical to consider:

Dividend stocks that also grow in valuation

In this sample scenario, let's assume you have $40,000 to start investing.

I pick this as a reasonable figure because comparison site Finder last year found that this is about the level of savings that the average Australian has stored away.

There are many different strategies you can employ to grow this nest egg, but I'll run with ASX dividend shares for this case.

There are some fantastic stocks out there that will not only pay you a serviceable dividend twice a year, but possess decent capital growth potential.

Take Ampol Ltd (ASX: ALD) and Super Retail Group Ltd (ASX: SUL) as examples.

They are paying excellent dividend yields of 7.1% and 6.3% respectively. Both are fully franked, so the amounts you actually receive may be more than that.

And the Ampol share price has risen 43% over the past five years, while Super Retail has rocketed 123%.

If you combine the two channels of returns, Ampol boasts a compound annual growth rate (CAGR) in excess of 14.5%. For Super Retail it's a mind-blowing 23.6%.

If you have these types of winners mixed into a well diversified portfolio, assisted by franking credits, there is absolutely no reason why you can't nab 12% a year.

It's not like these are crazy speculative startup stocks. They are established players in the S&P/ASX 200 Index (ASX: XJO).

Save and invest for 11 years

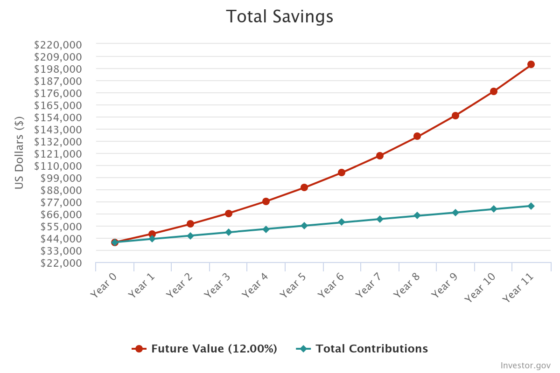

Going back to that $40,000, if you keep that growing at 12% per annum while you add in an extra $250 each month and reinvest all the returns, you will be laughing in no time.

After 11 years of yearly compounding, that nest egg will have grown to $201,105.

From then, stop reinvesting the dividends and the capital growth. Just bank it as cash instead.

You will have turned on a perpetual tap that averages $24,132 of second income each year.

How good is that!