Love it or loathe it, Valentine's Day has arrived.

Regardless of what you think of the concept, there is no doubt the day has become a big deal commercially.

"Australians expected to spend around $1.1 billion on Valentine's Day, according to Finder's research," said Moomoo market strategist Jessica Amir.

"The Australian Retailers Association and Roy Morgan suggest Australians plan to spend $485 million on Valentine's Day gifts, with 42% choosing roses."

And with all this consumption going on, there must be some ASX shares that will benefit, right?

Indeed, here are three stocks that Amir reckons could do pretty well out of all this outpouring of love:

First, some wine

Like it or not, many Australians like to commemorate a special occasion with a glass or two.

Especially so on a romantic day like Valentine's Day.

"What's a celebration without a bit of wine, of course," said Amir.

"Keep an eye out for the Australian global wine-making business Treasury Wine Estates Ltd (ASX: TWE)."

Even without 14 February, many professional investors are in love with Treasury Wine shares at the moment because of the possibility that China will reduce punitive tariffs on Australian wine imports.

According to CMC Invest, 12 out of 14 experts are recommending a buy for Treasury Wine shares.

The share price is already up more than 4% so far this year.

Then let's light the candles and see what happens

Then after you've enjoyed some social lubrication, it might be time to dim the house lights and fire up the candles.

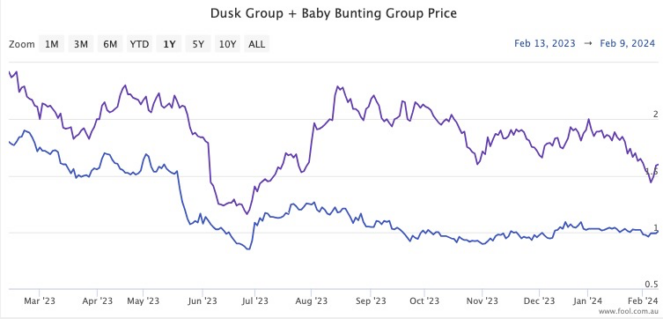

"For other Aussie stocks that might be boosted amidst V-Day spending, consider… candle stockist Dusk Group Ltd (ASX: DSK)."

The Dusk share price has lost 43% over the past year, but that does mean it now has a mouthwatering — and fully franked — 11% dividend yield.

So maybe if the candles led to the ultimate expression of love, there may be some further great news down the track.

And Amir has the ASX stock perfectly poised to take advantage.

"Offering Aussies baby products, Baby Bunting Group Ltd (ASX: BBN) might just tick up amidst Valentine's Day celebrations."

The retailer also pays out a decent income, currently distributing a fully franked yield of 4.5%.