All too often, we're led to believe the money is made by buying cheap ASX stocks. The problem is the term 'cheap' is usually tied to crude yardsticks.

One measure considered to be a trusty steed among experts for valuation is the price-to-earnings (P/E) ratio. Presenting a multiple of a company's share price to earnings per share (EPS), the metric is rather simple to apply. The value is typically compared against the average for its industry or benchmark index to determine value — cheap or expensive.

I'm here to say that sometimes you get what you pay for in the world of investing. Even a few stock-picking greats tend to agree.

When ASX stocks are 'expensive' by name, not by nature

Have you ever purchased a cheap product and been disappointed by its lack of performance or longevity? Or maybe there's something you never skimp out on, knowing the higher upfront cost works out less expensive over the life of ownership.

In those moments, you are calculating the sticker price and the intrinsic value over the life of the purchase. This is why the P/E ratio can lead an investor astray, in my opinion.

Think of it like this… say you're shopping for some fresh footwear. You probably know two variables: the asking price and probably a rough idea of how many times you'll wear them — call it a 12-month forward price-to-wear ratio.

This is somewhat similar to a P/E ratio for an ASX stock. You roughly know the multiple you will pay for the near-term (12-month) value as a function of price and estimated number of wears (or earnings) over the next year. However, what isn't so obvious is how long each of those shoes might last.

| Shoes | Product price | Number of wears | Forward price-to-wear ratio |

| Jaguar Max 4 | $180.00 | 50 | 3.6 |

| Leap 400 | $240.00 | 50 | 4.8 |

| NoCap Retro | $150.00 | 50 | 3.0 |

The table above suggests a pair of Leap 400s is the most expensive option, with a price-to-wear of 4.8 times.

But let's say the other two pairs only last a year while the dearer pair stays in good shape for three years or 150 wears. Suddenly, the justifiable price-to-wear ratio of the more expensive shoes is 9 times for it to be on par with the cheapest option.

Lifetime intrinsic value → $450 (justifiable price) / 150 wears = 3.0 price-to-wear ratio

Therefore, the next 12-months valuation → $450 / 50 wears = 9.0 price-to-wear ratio

In short, this means any price below $450 would suggest better value than even the cheapest choice.

This is how quality at a premium near-term valuation can still represent greater value than cheaper, poor-quality ASX stocks. That is why it's important to consider a company's long-term earning potential, not just the next year.

Justified quality on the ASX

An extremely successful investor by the name of Terry Smith is a beacon of knowledge when it comes to this notion of paying up for quality.

Smith has run the Fundsmith Equity Fund since 2010, achieving an annualised return of 15.4% since inception, outperforming the MSCI World Index. Yet, more often than not, the fund's holdings appear expensive based on a P/E ratio.

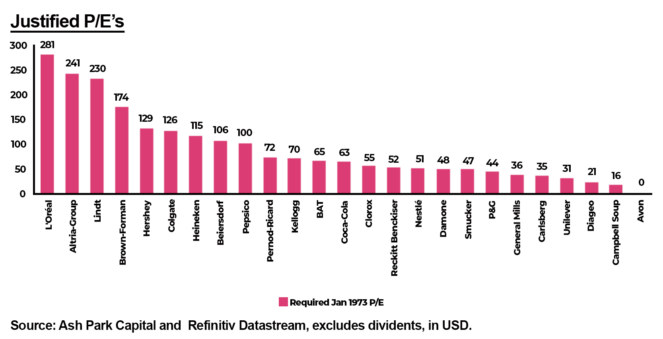

Smith has addressed concerns among his investors in the past by drawing upon history. For example, he showed the earnings multiple you could have paid in 1973 for companies and still have beaten the index, as depicted above.

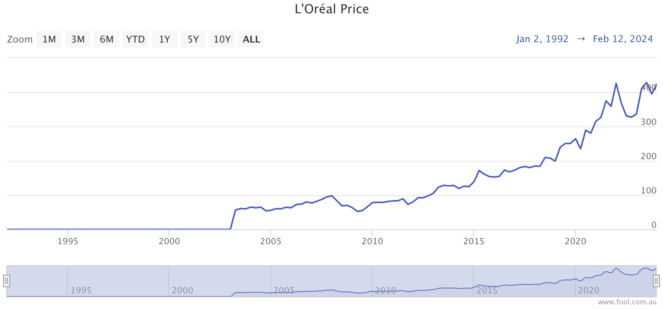

Yes, buying L'Oreal shares at 281 times earnings in 1973 ended up making sense despite its seemingly obscene valuation. Why? Because of the even more insane amount of growth that occurred over the next 50 years.

So, which ASX stocks do I think could be the L'Oreals of the world a decade from now?

- WiseTech Global Ltd (ASX: WTC) — P/E of 116 times

- Altium Ltd (ASX: ALU) — P/E of 67 times

- Lovisa Holdings Ltd (ASX: LOV) — P/E of 40 times

Although expectations might already be high for these three companies, I believe each has the potential to expand their businesses vastly over the next five to 10 years.