There's nothing sweeter in investing than buying ASX shares before they've had the majority of their rally.

The great news is that, at any given time, opportunities abound for such thrilling rides.

Right now, here are three ASX shares I think are well placed to head upwards:

Internal and external factors lining up nicely

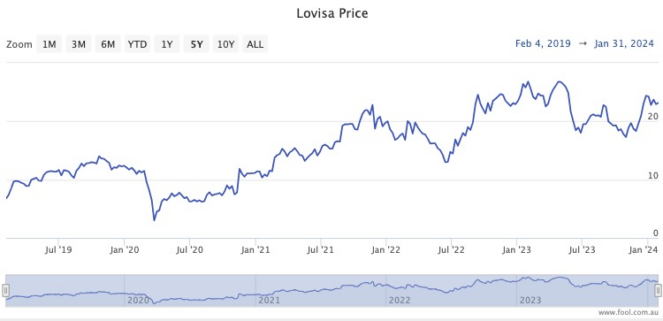

Lovisa Holdings Ltd (ASX: LOV) shares had an up-and-down 2023.

And it's no wonder, with 13 interest rate rises deliberately distressing consumers and the consumer discretionary sector.

Through all this though, the budget jewellery retail business has been expanding.

Only a couple of months ago, the company revealed that its first stores in mainland China and Vietnam respectively were imminent.

Rates could stabilise this year and even come down, providing much-needed relief for cash-strapped consumers.

So after spending the middle majority of last year not knowing which way to go, it seems Lovisa shares are ready to trend upwards again.

The shares have now gained close to 30% since the start of November, as they inch closer back to their all-time highs achieved last May.

Professional investors are bullish on Lovisa from this point on.

According to CMC Invest, eight out of 12 analysts rate the stock as a buy.

The ASX shares that haven't yet broken out

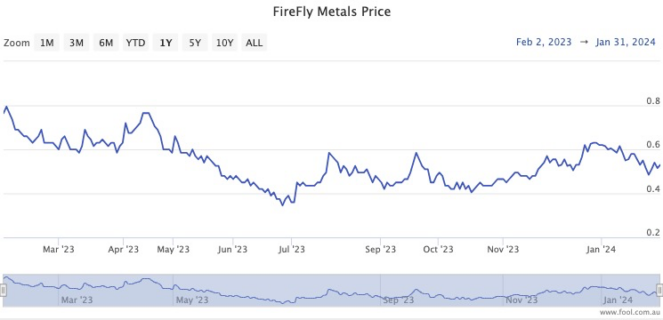

Over in the mining sector, Firefly Metals Ltd (ASX: FFM) is grabbing the attention of many fund managers.

Argonaut dealer Harrison Massey explained the excitement last week.

"FireFly, formerly known as AuTECO Minerals, completed the acquisition of the Green Bay Copper-Gold project in Newfoundland, Canada, in October 2023," Massey told The Bull.

"The asset includes a significant ready-to-go underground copper deposit, which, in our view, offers considerable upscale potential amid a history of high-grade copper production."

Aside from Massey's team, CMC Invest indicates all three of Canaccord Genuity, Euroz Hartleys, and Shaw & Partners analysts believe Firefly shares are a strong buy.

This is why, after a flat period over December and January, the stock could break out for a rally soon.

Calming market fears

Healthcare stock Resmed CDI (ASX: RMD) looks poised for a bullish 2024 after putting last year's Ozempic market panic behind it.

The concern was that such GLP-1 type of weight loss drugs could reduce obesity substantially around the world, thereby cutting down a major precursor of sleep apnoea.

ResMed makes devices that treat respiratory issues during sleep, so investors sold off in droves last reporting season.

But after a boom quarterly update last month that showed the worries were overstated, the ResMed share price is already 15% up this year.

Plenty of pros are backing a 2024 rally for the stock, with 18 out of 25 analysts surveyed on CMC Invest recommending buying right now.