Just $10,000 is all you need to create a self-sustaining machine that could pay out $500 cash each month for the rest of your life.

Sounds incredible, but it's not that complicated.

Invest wisely in ASX shares and summon up the patience to allow compounding to do its job, and you could find yourself smiling at the passive income coming into your bank account each month.

Take a look at this scenario as an example:

Compounding and ASX shares are your friends

Construct a diversified portfolio of ASX shares with that $10,000 and you're on your way.

It doesn't matter whether your tastes prefer ASX dividend shares or growth stocks. Getting started is the biggest step.

My opinion is that, over the long term, you can pull in 12% compound annual growth rate (CAGR) regardless of the route you take.

Just take a quick squiz at some of the quality stocks available on the S&P/ASX 200 Index (ASX: XJO).

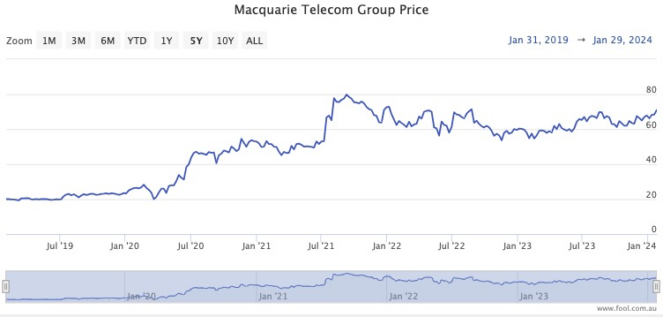

Data centre operator and telco Macquarie Technology Group Ltd (ASX: MAQ) has returned 265% over the past five years, for a CAGR in excess of 29%.

Over in dividend land, investment bank Macquarie Group Ltd (ASX: MQG) has risen 62% over the same period with a current dividend yield of 3.75%. Combining those equates to a 13.9% CAGR.

For a bit of both, how about retailer Lovisa Holdings Ltd (ASX: LOV), which has put on 243% of capital growth in five years while paying out a 3% yield? That takes the CAGR up over the 30% mark.

How to grab that sweet passive income

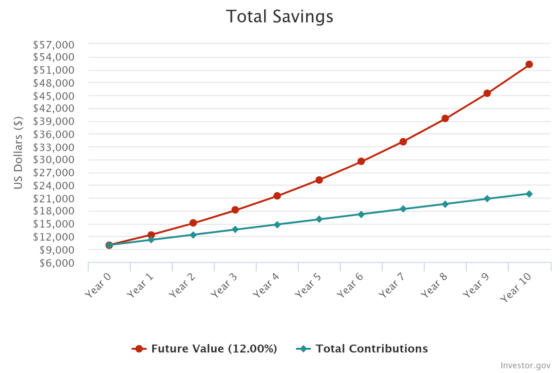

So send that $10,000 on its way then promise yourself to save $100 each month to add to this nest egg.

After 10 years, that portfolio could have reached $52,116.

From that point on, if you cash out the 12% annual return, that's $6,253 each year.

That's a passive income of $520 per month.

Mission accomplished.

Of course, there are levers you can pull if you want more passive income.

You can leave the investment growing for longer than 10 years. If you resist cashing out for five more years, that portfolio will be near enough to $100,000.

That will provide you passive income just short of $1,000 each month.

Another way is to increase your contributions each month.

If you can manage to add $200 instead of $100 every time the calendar turns, after 10 years the portfolio will be more than $73,000.

From then you can bring in monthly passive income of around $730.