Bonds are among the most important asset classes in the world. Bonds help fund government spending and can support businesses, too (usually in the form of capital expenditure).

But, as good as bonds are, I'm going to tell you why I prefer to invest in ASX shares.

First, how do bonds work?

If a company or a government wants $1 billion of funding for something, they'll typically issue bonds to investors, and then investors will receive interest based on the terms and length of the bond. In other words, bonds are debt.

Bond prices do move around, but bondholders are fairly well protected because they are a form of creditor that needs to be repaid before shareholders if the business or venture goes into liquidation. That's how the capital structure works with businesses.

With interest rates now much higher than two years ago, people can gain a better income return from bonds, making them more attractive. There may also be an opportunity to buy bonds at a slightly cheaper price compared to their face value.

I wouldn't suggest investing in 'risky' bonds, where there can be a greater discount. I think they should be left to institutional investors.

Why I prefer investing in ASX shares over bonds

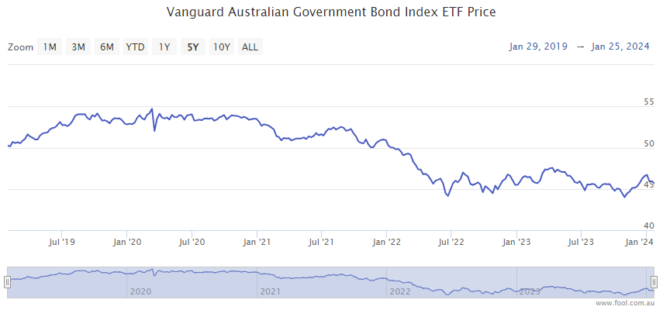

As we saw in 2022, bond prices can fall – even government bonds. I don't think they're quite as safe as some investors think. Just look at what has happened to the Vanguard Australian Government Bond Index ETF (ASX: VGB) in the chart below.

That's why I prefer a savings account as the safest place to put my money.

For me, bonds have a limited upside, whereas ASX shares can produce a much stronger return, particularly when it comes to capital growth.

For example, I think the compounding potential of Wesfarmers Ltd (ASX: WES) is much stronger than bonds because of the business strength (including Bunnings and Kmart) and profit re-investing.

I believe Wesfarmers can grow for many years into the future while also paying dividends.

Bonds aren't re-investing profit for more growth – they only pay interest. But, bond investors still face risk.

I think bonds do have a place, particularly in diversified funds such as 'balanced' superannuation accounts.

I'm not saying that every single ASX share is a better investment than every bond, but in general, I like the prospect of capital growth and dividends of ASX shares while investing at the right price.

I like to regularly write about names I've invested in my own portfolio, such as Johns Lyng Group Ltd (ASX: JLG), Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) and Brickworks Limited (ASX: BKW).