Believe it or not, many Australians are closer to retirement than they think.

That's because ASX shares and compounding can accelerate your investment, taking it to a level where each year a useful amount of cash can be extracted.

Let's take a hypothetical look at how one can do this:

Growth vs dividend vs cyclical shares

We'll imagine you can start with $40,000 of stocks.

Why that number? Comparison site Finder last year conducted research that found the average amount of savings Australians had in the bank was around that mark.

While there are many different styles one could employ in constructing a stock portfolio, personally I'm a fan of ASX growth shares.

That's because I find it fun to watch the businesses I've backed grow to new levels. It's fascinating to see what new products and services these companies will come up with next, and the markets that they will expand to.

It's almost like watching sport.

Also, I find growth stocks arguably lower maintenance than ASX dividend shares or cyclical stocks.

You don't have to worry about reinvesting dividends each year, which requires decisions about what stocks to buy and complicates capital gains tax calculations.

And cyclical stocks require careful monitoring of macroeconomics and commodity prices, and possible buying and selling, which is a hassle I don't need.

What kind of returns could I aim for?

Now, with that $40,000 growth portfolio, I reckon it's not out of the question to get 12% compound annual growth rate (CAGR) out of it in the long run.

Is that realistic? Take some popular stocks as an example:

- Lovisa Holdings Ltd (ASX: LOV) shares have tripled over the past five years, meaning a CAGR of 24.6%

- An arguably more mature company, Xero Ltd (ASX: XRO), has seen its shares rise 166% over the same time, which equates to 21.6% annually

- And Resmed CDI (ASX: RMD), despite all its Ozempic-related troubles in the past six months, has still gained 84.4% over the last half-decade for a CAGR of 13%

Of course, not every stock in the portfolio will necessarily do as well as the above.

But with careful diversification, these sorts of stars will carry your other picks that haven't turned out so well, and overall you gain 12% each year.

Passive income to retire on

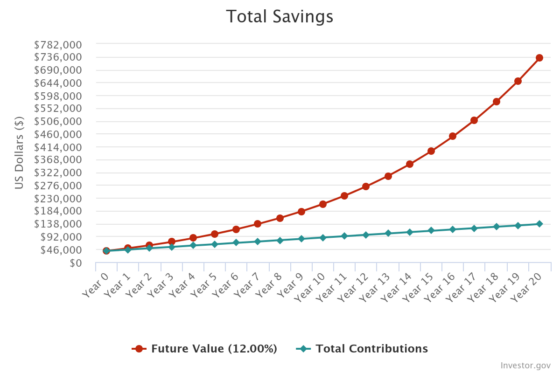

So that $40,000, with $400 added each month and growing at 12% a year, will end up around:

- $208,000 after 10 years

- $397,000 after 15 years

- $731,000 after 20 years

The idea is that whenever you decide to turn on the passive income tap, you start selling off that year's gains and pocket the proceeds.

You can pick when you retire. The later you can leave it, the greater the passive income will be.

In our example, after 10 years the annual income will be $25,000. If you can wait 15 years, the yearly reward will be more than $47,000.

If you have enough patience to not touch the nest egg for two decades, you can harvest an enticing passive income each year in excess of $87,000.

Can you even imagine receiving $87,000 every 12 months in return for no work?

That's how I'm planning to put my feet up.