Navigating the sometimes stomach-churning volatility associated with investing in ASX shares is not for the faint-hearted. That's why some people choose to park their money in a term deposit instead, assuming it's risk-free.

But no investment is completely without risk. Not even bank savings accounts and term deposits.

Legendary investor Warren Buffett once described investing in cash and cash equivalents as "a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value".

The main reason for this is inflation. Even if your primary goal is Buffett's number one investment rule – to not lose money – your term deposit may do just that when bank interest rates don't keep up with Australia's inflation rate.

So much for a safer and more stable investment than ASX shares – your wealth could actually be diminishing in real terms!

On that note, we turned to our Foolish writers for some more appealing possibilities and asked them which ASX shares they think offer the best alternative to a term deposit in 2024.

With their conservative investor hats on, here is what the team came up with:

7 ASX stock tips for risk-averse investors in 2024

- GQG Partners Inc (ASX: GQG), $5.05 billion

- Medibank Private Ltd (ASX: MPL), $10.60 billion

- Washington H Soul Pattinson & Company Ltd (ASX: SOL), $11.89 billion

- Coles Group Ltd (ASX: COL), $20.77 billion

- Telstra Group Ltd (ASX: TLS), $45.87 billion

- ANZ Group Holdings Ltd (ASX: ANZ), $78.59 billion

- Commonwealth Bank of Australia (ASX: CBA), $189.70 billion

(Market capitalisations as of 19 January 2024).

Why our Foolish writers think you should buy these ASX shares instead of parking your cash in the bank

GQG Partners Inc

What it does: GQG Partners is a multinational investment services company headquartered in the United States.

By Tony Yoo: This $5 billion US outfit appears to be on the upward part of its business cycle, as investor sentiment is turning more positive due to inflation settling down and interest rate cuts potentially looming.

Already, many ASX stock investors have woken up to this, sending the GQG share price soaring more than 31% since 9 November. Despite the bull run, all five analysts surveyed on CMC Invest are tipping this financial services stock as a buy.

As a foreign company, the dividends come with no franking. However, the yield is still a very respectable 5.1%. That's certainly better than most one-year term deposits, which have little prospect of capital growth.

Motley Fool contributor Tony Yoo does not own shares of GQG Partners Inc.

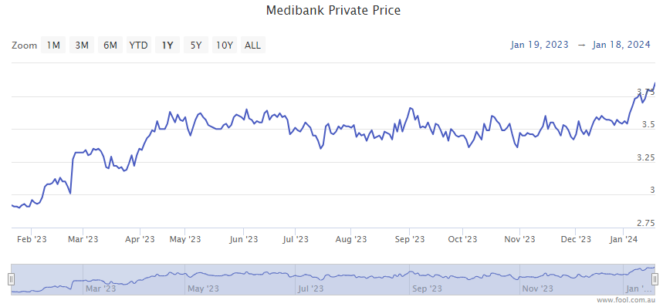

Medibank Private Ltd

What it does: Medibank Private is Australia's largest health insurer, providing coverage to more than 4 million customers across its Medibank and ahm brands. The company derives most of its income from the difference between claims made and premiums charged. Additional income comes from returns on its investment portfolio – the funds it holds to pay out claims.

By Mitchell Lawler: If I were hoping to earn more than a term deposit without taking too much risk, I'd search for a deep-seated company with no indication of disappearing. Companies that will play a role in our kid's lives, and possibly even their children.

Medibank Private holds such a strong brand that not even a catastrophic cyber breach could stop it from reaching record customer numbers in FY2023. That speaks to the loyalty and brand strength this insurer holds in the Australian market.

As the Australian population grows through migration, Medibank could see its paying customers continue to swell. Throw in a fairly consistent ~4% in dividends each year, and I think this company could provide 10% to 11% in annual returns for the next five years – double what is commonly possible from a term deposit.

Motley Fool contributor Mitchell Lawler does not own shares of Medibank Private Ltd.

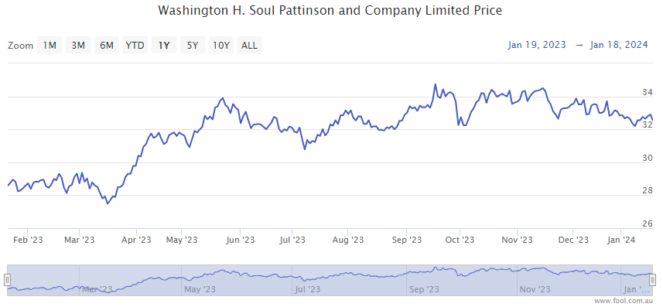

Washington H Soul Pattinson & Company Ltd

What it does: Investment company Soul Pattinson joined the ASX in 1903, so it's been listed for more than a century. It is invested in numerous sectors, including telecommunications, building products, financial services, agriculture, swimming schools, resources, and many more.

By Tristan Harrison: Soul Patts has proven its longevity, surviving two world wars, two global pandemics, and numerous recessions and market crashes. The growing diversification of the company's portfolio helps protect it against any sector-specific risks.

The company has paid a dividend every year since it was listed in 1903 — a great record that very few global businesses can exceed. Soul Patts has also grown its annual ordinary dividend every year since 2000.

Past performance is not a guarantee of future results, but Soul Pattinson has a long track record of delivering capital growth, partly because it continues to re-invest retained net investment cash flow into more ASX shares and other assets each year, which also helps grow its dividend potential.

Soul Patts has a grossed-up dividend yield of 2.64% at the close on Friday.

Motley Fool contributor Tristan Harrison owns shares of Washington H Soul Pattinson and Co Ltd.

Coles Group Ltd

What it does: Coles Group is the second-largest grocery and supermarket operator in Australia. It owns the huge network of Coles supermarkets, as well as liquor store chains like First Choice.

By Sebastian Bowen: There are two reasons I think Coles shares would make a great alternative to a term deposit in 2024.

Firstly, I've been mightily impressed with Coles' dividend track record ever since the company was first floated back in late 2018. Coles has delivered annual dividend pay rises every single year since 2019 and now offers a compelling, fully-franked yield of well over 4%.

Secondly, thanks to the nature of Coles' consumer staples business, this company's earnings are highly durable and defensive. That means this dividend is, in my view, unlikely to be substantially cut if there's a recession or other economic malady.

All in all, it's my belief that Coles stock is one of the steadiest income providers on the ASX, and it would make a great alternative to a term deposit investment today.

Motley Fool contributor Sebastian Bowen does not own shares of Coles Group Ltd.

Telstra Group Ltd

What it does: Telstra is Australia's leading telecommunications and technology company, offering a full range of communications services. At the last count, it was providing around 22.5 million retail mobile services and 3.4 million retail bundle and data services.

By James Mickleboro: If you're looking to invest in an ASX share over a low-risk term deposit, you're going to need a compelling risk/reward balance. The good news is that I believe that Telstra offers exactly this.

In addition, the telco giant has defensive qualities, making it a lower-risk option compared to the average ASX stock.

Getting back to that risk/reward proposition, Goldman Sachs currently has a buy rating and a $4.70 price target on Telstra shares, which implies an 18% upside from Friday's closing price of $3.97.

The analyst also expects a growing stream of dividends. Goldman is forecasting fully-franked dividends per share of 18 cents, 19 cents, and 20 cents over the next three financial years. This will mean yields of 4.5%+ each year.

Motley Fool contributor James Mickleboro does not own shares of Telstra Group Ltd.

ANZ Group Holdings Ltd

What it does: ANZ is a major bank and mortgage lender that also has the largest institutional banking business of the big four Australian banks.

By Bronwyn Allen: Bank shares make better investments than term deposits because they typically offer strong, reliable dividend yields, full franking credits, and the possibility of capital growth.

In 2023, ANZ shares paid $1.75 per share in dividends (that's a 6.7% yield based on today's share price of $26.13) and delivered 9.5% capital growth. Altogether, a 16.2% return. That's a lot better than the 5.15% offered by the best term deposits.

The consensus forecast for ANZ's 2024 dividend is $1.62 per share. Goldman Sachs has a buy rating and a 12-month price target of $27.85.

Motley Fool contributor Bronwyn Allen owns shares of ANZ Group Holdings Ltd.

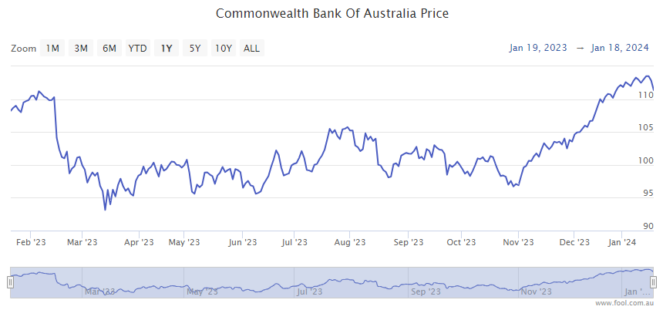

Commonwealth Bank of Australia

What it does: With a market cap of almost $190 billion, CBA counts as Australia's biggest bank. CommBank offers a range of integrated financial services. These include retail, business and institutional banking, funds management, superannuation, life insurance, general insurance, and broking services.

By Bernd Struben: In 2023, CBA shares gained 9.0%, well ahead of the best term deposit rates. Atop that, CommBank also paid out $4.50 a share in fully franked dividends. That saw the accumulated value of CBA shares gain 13.4% over the year, with some potential tax benefits.

And I believe CBA is well positioned to deliver deposit-rate-beating returns again in 2024, with considerably less risk than investing in small-cap ASX growth stocks.

From a safety standpoint, I like that the bank ended FY 2023 in a strong position in case of unexpected financial shocks. CBA's common equity tier 1 (CET1) ratio increased 0.46% to 11.8%.

Motley Fool contributor Bernd Struben does not own shares in Commonwealth Bank of Australia.