It's that time of the year when the crystal ball is dusted off for some bold predictions.

Of course, no one has a working fortune-telling device and the most expert of experts actually can't say with any more certainty than anyone else about what will happen to ASX shares.

But we can take some educated guesses.

Since lithium has been such a hot topic the past few years, let's take a look at miner Lake Resources N.L. (ASX: LKE).

Can it possibly double its share price this year?

Annus horribilis

Before we look to the future, let's examine the past.

The past 12 months has seen global lithium prices crash.

According to TradingEconomics, lithium carbonate was selling for 487,500 CNY per tonne early 2023 but is now going for less than 97,000 CNY.

Despite its lustre as a critical raw material for the world's transition to lower carbon emissions, last year's economic uncertainty was brutal on lithium.

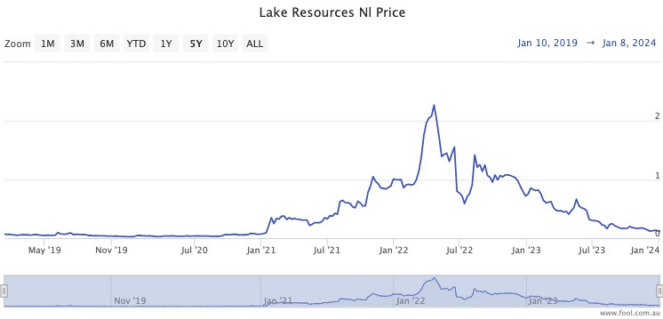

This might go some way to explaining why the Lake Resources share price has tumbled more than 85% since a year ago.

What Lake Resources can do internally, and the external factor it can't control

One important factor to remember when assessing Lake Resources' potential is that it is currently highly dependent on one mine named Kachi in Argentina.

This does give it explosive potential to double its share price in 2024 if favourable results are shown from the samples collected there.

But there is also substantial risk that the stock tanks even further if the market dislikes the progress.

To demonstrate this volatility, just before Christmas Lake Resources shares jumped 15% in the same day, after positive definitive feasibility study data was released.

The other driver of the shares, of course, is the lithium price.

In the longer run, many experts do not expect the commodity price to remain in the current doldrums. There is simply too much demand forthcoming in order to build all the electric cars and high-power batteries that the world requires.

But will the lithium price pick up in 2024? No one knows.

It's highly dependent on how fast the western consumers can recover from the painful interest rates hikes of the past two years and whether China can finally trigger a much-delayed post-pandemic economic boom.

Can history repeat?

Anchoring is dangerous because the past is never an indicator of future performance.

However, analysing the historical record of the Lake Resources share price can give us a clue as to how the market could respond to good or bad news.

Between February and April in 2022, the shares rocketed 154% in less than two months.

During the 2021 calendar year, the Lake Resources price gained a whopping 1,343%.

These events show the market is capable of sending this lithium stock into the stratosphere if it sees developments that it likes.

So can Lake Resources shares double in 2024?

It sure can. But it needs everything to go right.