ASX energy shares dipped in 2023 with the S&P/ASX 200 Energy Index (ASX: XEJ) falling 3.76% while the benchmark S&P/ASX 200 Index (ASX: XJO) rose by 8.13%.

These were the best-performing energy shares of the ASX 200 based on share price growth over the year.

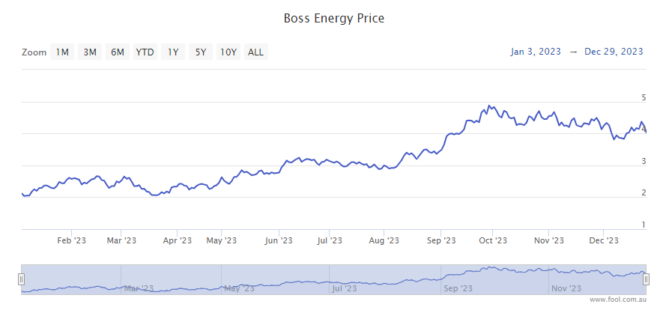

Boss Energy Ltd (ASX: BOE)

Last year was a big year for ASX uranium shares, and Boss Energy was the star performer. The ASX 200 energy share rose by 89.2%. In the era of global decarbonisation, many countries are embracing nuclear energy as a means of generating green power. For example, the United Kingdom has just announced a 300 million pound investment into domestic nuclear power production. It will be the first European nation to launch a high-tech, high-assay, low-enriched uranium (HALEU) nuclear fuel program. Such activity has pushed the uranium price to a 17-year high today of US$91 per pound. Boss signed its first US supply agreement last month and completed an oversubscribed Share Purchase Plan (SPP) last week. Boss was seeking to raise $10 million via the SPP following a $205 million institutional placement. It received $29.6 million worth of applications and has exercised its discretion to raise the SPP target to $15 million.

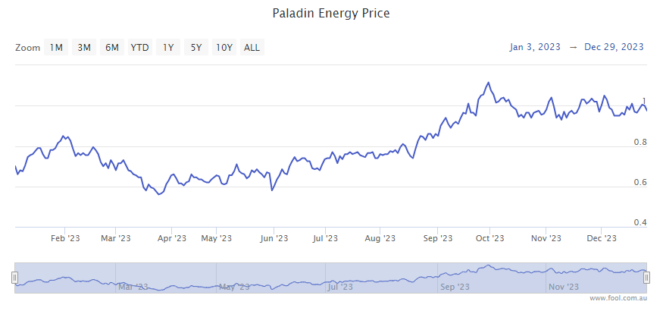

Paladin Energy Ltd (ASX: PDN)

Fellow ASX uranium share Paladin benefitted from the same global tailwinds as Boss Energy. It was the second-best performer among ASX 200 energy stocks with a 41.42% share price gain. Paladin hopes to reopen its Langer Heinrich Mine in Namibia and achieve first production in the first quarter of the new year. The miner also took 100% ownership of the Michelin Project in Canada last year. The company has been granted mineral licences for prospective new ground adjoining the Michelin Project, with exclusive rights to explore those tenements.

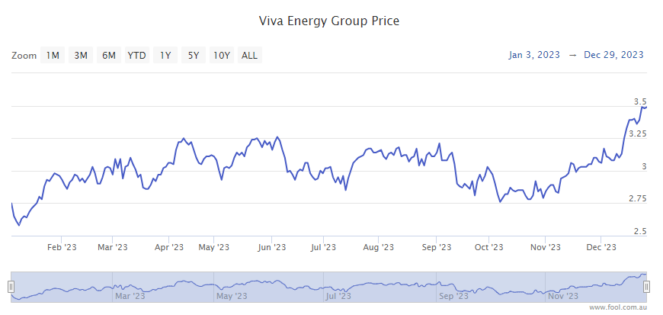

Viva Energy Group Ltd (ASX: VEA)

The third best-performing ASX energy share of 2023 was Viva Energy. Viva is Australia's second-largest refined transport fuel supplier. The company produces, imports, blends, and delivers about one-quarter of Australia's fuel requirements. The Viva Energy share price rose by 27.84% in 2023. Last month, Viva got the green light from the Australian Competition and Consumer Commission (ACCC) on its proposed purchase of OTR Group. The ACCC made its decision after accepting a court-enforceable undertaking from Viva that it would divest 25 company-operated sites in South Australia to a purchaser approved by the ACCC. Viva expects to complete the acquisition of OTR Group in the first half of the new year, subject to Foreign Investment Review Board approval.

Find out which ASX 200 stocks were the No 1. performers across the other 10 market sectors in 2023.