S&P/ASX 200 Index (ASX: XJO) uranium share Boss Energy Ltd (ASX: BOE) is dipping into the red today.

Shares in the ASX uranium stock closed yesterday trading for $4.13. In morning trade on Thursday, shares are swapping hands for $4.09 apiece, down 0.9%.

For some context, the ASX 200 is down 0.6% at this same time.

Boss Energy shares are slipping despite the announcement this morning of the miner's first United States sales agreement.

Here's what's happening.

What sales agreement did the ASX 200 uranium share announce?

The Boss Energy share price is struggling today despite the ASX 200 uranium share reporting it just inked its first binding sales contract with a major publicly listed US power utility.

The agreement will see Boss supply one million pounds of uranium, sourced from its Honeymoon Project in South Australia. The contract spans a seven-year period, running from 2025 through to the end of 2031.

Boss will sell its uranium based on market-related pricing. The company said that the agreement contains a ceiling price and a floor price above its forecast production costs at Honeymoon.

Other terms and conditions of the agreement were said to be in line with industry standards.

Commenting on the sales agreement achieved by the ASX 200 uranium share, managing director Duncan Craib said, "Signing our first sales contract is a major milestone for Boss and another key de-risking event for the Honeymoon Project."

Craib noted that with production about to start at Honeymoon, and with the project running on time and on budget, "We are extremely well-placed to capitalise on the rising uranium price."

Craib added:

Now we also have a binding sales contract in place which gives us financial security while allowing us to retain exposure to further increases in the uranium price. In the process, we have established a long-term relationship with this large strategic customer.

Boss Energy share price snapshot

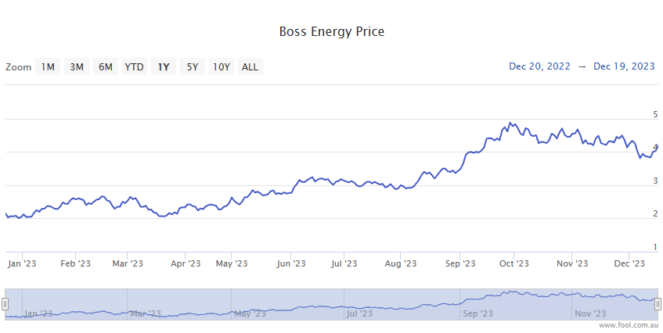

The Boss Energy share price has benefited from soaring uranium prices this year. Yellowcake is up some 55% year to date, trading north of US$85 per pound.

That's helped boost the ASX 200 uranium share by 102% so far in 2023.