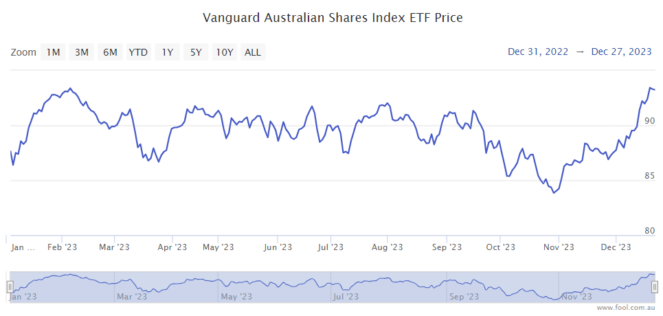

The Vanguard Australian Shares Index ETF (ASX: VAS) has had a solid year to date – it's up close to 10%, plus the dividends paid. After a solid 12 months, is this still a good time to invest?

The return of an exchange-traded fund (ETF) is dictated by the performance of the underlying holdings.

In 2023, names like BHP Group Ltd (ASX: BHP) and Commonwealth Bank of Australia (ASX: CBA) have also risen by around 10%. As some of the biggest businesses in the portfolio, they have the largest impact on the overall return.

Is this a good time to invest in the VAS ETF?

It can be a mistake to think that just because an investment has risen, it's done rising forever. But, also don't expect recent capital growth to continue (particularly in the short-term).

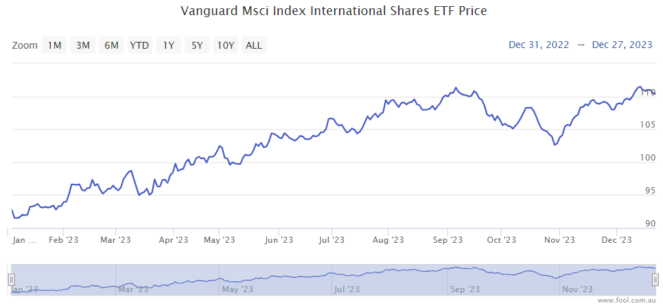

Look at how the Vanguard MSCI Index International Shares ETF (ASX: VGS) has continued rising over time. Over time, if companies are increasing their profits then this gives share prices a good opportunity to keep going up in the months and years ahead.

Businesses like BHP, CBA, Westpac Banking Corp (ASX: WBC), ANZ Group Holdings Ltd (ASX: ANZ), National Australia Bank Ltd (ASX: NAB), Rio Tinto Ltd (ASX: RIO), Fortescue Ltd (ASX: FMG) and Telstra Group Ltd (ASX: TLS) are known for paying large dividends, meaning they're not re-investing a lot back into their businesses for more growth.

The ASX mining shares have a sizeable presence in the index, so the strengthening iron ore price is helping produce stronger profits. 2024 could be a good year for shareholders of ASX iron ore shares.

I do have a shorter-term concern that today's valuation is a little elevated. I like buying cyclical ASX shares (like iron ore miners) when there is pessimism about the sector. ASX bank shares may see bigger arrears next year because of higher interest rates.

Financials and miners make up just over half of the Vanguard Australian Shares Index ETF's portfolio, so they'll play an important role in 2024.

Of course, it would have been better to buy two months ago, as we can see on the chart below.

Always a good time to invest?

It could be said that it's always a good time to invest in the VAS ETF if someone is following a regular investment strategy and dollar-cost averaging (DCA).

If someone just invests $1,000 every month, then they'd be catching the highs and the lows of any market movements. We don't know what share prices will do in the short term, but I think staying optimistic about the long term is the right way to go.

Valuations certainly don't seem extreme in Australia. Banks could perform better than expected and commodity prices could keep rising in 2024. I think this year has shown the market is capable of rising in spite of worrisome news.

So, I'd suggest that while it may not be the best price to invest at this year, the VAS ETF could still be a good investment for the long-term at the current level. I'm just not expecting a strong capital growth rate – dividends will play an important role.